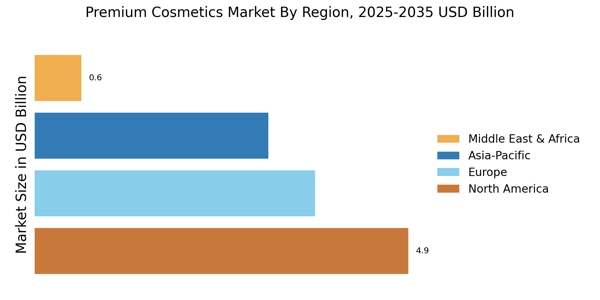

North America : Market Leader in Premium Cosmetics Market

North America is the largest market for premium cosmetics, accounting for approximately 40% of the global market share. The region's growth is driven by increasing disposable incomes, a strong focus on personal grooming, and a rising trend towards organic and cruelty-free products. Regulatory support for clean beauty initiatives further fuels demand, making it a vibrant market for innovation and sustainability. The United States leads the North American market, with significant contributions from Canada. Major players like Estée Lauder and L'Oreal dominate the landscape, offering a wide range of products. The competitive environment is characterized by continuous product launches and marketing strategies targeting millennials and Gen Z consumers, who are increasingly influencing purchasing decisions.

Europe : Cultural Hub for Beauty Trends

Europe is the second-largest market for premium cosmetics, holding around 30% of the global market share. The region benefits from a rich cultural heritage in beauty and fashion, driving demand for high-quality, luxury products. Regulatory frameworks, such as the EU Cosmetics Regulation, ensure product safety and efficacy, fostering consumer trust and encouraging market growth. France and Germany are the leading countries in this market, with iconic brands like Chanel, Dior, and Lancôme headquartered in France. The competitive landscape is marked by a blend of established luxury brands and emerging niche players focusing on sustainability and ethical sourcing. The region's consumers are increasingly seeking personalized beauty solutions, further driving innovation in product offerings.

Asia-Pacific : Emerging Market with High Growth

Asia-Pacific is witnessing rapid growth in the premium cosmetics market, accounting for approximately 25% of the global share. The region's growth is fueled by rising disposable incomes, urbanization, and a growing middle class that is increasingly investing in personal care. Regulatory bodies are also promoting safe and effective beauty products, enhancing consumer confidence and market expansion. China and Japan are the leading countries in this region, with a strong presence of both local and international brands. Key players like Shiseido and L'Oreal are adapting their strategies to cater to diverse consumer preferences. The competitive landscape is dynamic, with a surge in e-commerce and social media influencing purchasing behaviors, particularly among younger consumers who prioritize brand authenticity and engagement.

The premium cosmetics China CAGR is particularly noteworthy, with the country experiencing one of the highest growth rates in the Asia-Pacific region at approximately 8.2% during the forecast period. China's burgeoning middle class, combined with increasing digital penetration and e-commerce adoption, positions it as a critical market for premium beauty brands. The premium cosmetics China CAGR reflects strong consumer appetite for luxury skincare and makeup products, driven by rising disposable incomes and growing beauty consciousness among younger demographics. International brands are increasingly tailoring their strategies to capture this lucrative market segment.

Middle East and Africa : Untapped Potential in Cosmetics

The Middle East and Africa represent an emerging market for premium cosmetics, holding about 5% of the global market share. The region's growth is driven by increasing urbanization, a young population, and rising disposable incomes. Regulatory frameworks are evolving to support the cosmetics industry, enhancing product safety and quality, which is crucial for consumer trust and market growth. Countries like the UAE and South Africa are leading the market, with a growing number of international brands entering the region. The competitive landscape is characterized by a mix of local and global players, with a focus on luxury and high-quality products. The region's consumers are increasingly influenced by global beauty trends, creating opportunities for innovative product offerings and marketing strategies that resonate with local cultures.