Evolving Demographics

The Cosmetic Implant Market is witnessing a demographic shift, with an expanding range of age groups seeking cosmetic enhancements. Traditionally associated with younger individuals, the market is now seeing increased interest from older demographics who desire to maintain a youthful appearance. This trend is supported by a growing acceptance of cosmetic procedures among older adults, who are more willing to invest in their looks. Additionally, men are increasingly participating in the market, accounting for a notable percentage of cosmetic implant procedures. This diversification of the consumer base suggests that the Cosmetic Implant Market is evolving to meet the needs of a broader audience, potentially leading to increased market penetration and growth.

Influence of Social Media

The Cosmetic Implant Market is increasingly influenced by social media platforms, which serve as powerful tools for shaping consumer perceptions and preferences. Social media has created a culture where individuals share their cosmetic experiences, leading to greater visibility and acceptance of cosmetic procedures. Influencers and celebrities often showcase their enhancements, which can drive demand among their followers. This phenomenon has resulted in a significant increase in inquiries and procedures, particularly among younger audiences. Data suggests that nearly 40% of individuals considering cosmetic procedures cite social media as a primary source of inspiration. As this trend continues, the Cosmetic Implant Market is likely to benefit from heightened awareness and interest, potentially leading to a surge in market growth.

Technological Innovations

Technological advancements are significantly shaping the Cosmetic Implant Market, introducing new materials and techniques that enhance the safety and effectiveness of procedures. Innovations such as 3D printing and minimally invasive techniques are revolutionizing the way implants are designed and inserted. For instance, the introduction of biocompatible materials has improved patient outcomes and reduced recovery times. Furthermore, the market is witnessing an increase in the use of augmented reality for pre-surgical planning, allowing patients to visualize potential results. These advancements not only improve the overall patient experience but also expand the range of options available, thereby attracting a broader audience. As technology continues to evolve, the Cosmetic Implant Market is expected to expand, with a projected market value reaching several billion dollars by the end of the decade.

Increasing Disposable Income

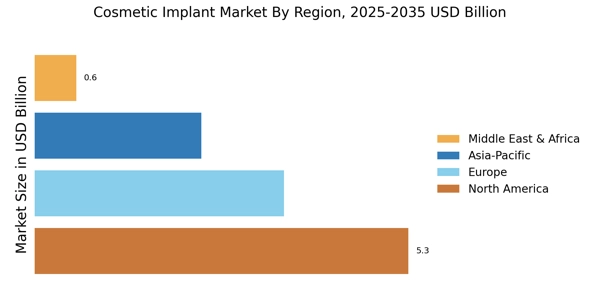

The Cosmetic Implant Market is poised for growth as rising disposable incomes enable more individuals to invest in cosmetic procedures. Economic improvements in various regions have led to increased spending power, allowing consumers to prioritize aesthetic enhancements. This trend is particularly pronounced in emerging markets, where a growing middle class is seeking to enhance their appearance through cosmetic implants. Market analysis indicates that as disposable income rises, the demand for cosmetic procedures, including implants, is expected to increase correspondingly. This economic shift suggests a promising outlook for the Cosmetic Implant Market, as more consumers view cosmetic enhancements as attainable and desirable.

Rising Aesthetic Consciousness

The Cosmetic Implant Market is experiencing a notable surge in demand driven by an increasing societal emphasis on aesthetics. Individuals are becoming more aware of their appearance, leading to a heightened interest in cosmetic procedures. This trend is particularly evident among younger demographics, who are more inclined to pursue cosmetic enhancements. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years. This growth is indicative of a broader cultural shift towards self-improvement and personal branding, where physical appearance plays a crucial role. As consumers prioritize their looks, the Cosmetic Implant Market is likely to see sustained growth, with innovations in implant technology further fueling this trend.