E-commerce Growth

The rapid growth of e-commerce is significantly influencing the Soft Drinks Packaging Market. As online shopping becomes increasingly prevalent, the demand for packaging that ensures product safety during transit is rising. Packaging solutions that are lightweight yet durable are gaining traction, as they reduce shipping costs while protecting products. Additionally, the need for visually appealing packaging that attracts consumers in a digital marketplace is becoming more pronounced. Companies are investing in innovative designs that stand out in online listings, thereby enhancing brand visibility. This trend is likely to continue, as e-commerce is projected to expand further, necessitating adaptations in packaging strategies to meet evolving consumer expectations.

Regulatory Compliance

Regulatory compliance is an essential driver in the Soft Drinks Packaging Market. Governments worldwide are implementing stricter regulations regarding packaging materials and waste management. These regulations aim to reduce environmental impact and promote recycling initiatives. Companies are thus compelled to innovate and adapt their packaging solutions to meet these legal requirements. Compliance not only ensures market access but also enhances brand reputation among environmentally conscious consumers. Furthermore, adherence to regulations can lead to cost savings in waste management and material sourcing. As the regulatory landscape evolves, companies that proactively embrace compliance are likely to gain a competitive edge in the market.

Health and Wellness Trends

The growing focus on health and wellness is reshaping the Soft Drinks Packaging Market. As consumers increasingly seek healthier beverage options, packaging plays a vital role in conveying product benefits. Clear labeling and transparent packaging that highlights nutritional information are becoming essential. Moreover, the rise of functional beverages, such as those enriched with vitamins or probiotics, necessitates packaging that communicates these attributes effectively. This trend is further supported by market data indicating a shift towards low-calorie and sugar-free options. As health-conscious consumers continue to prioritize wellness, the industry must adapt its packaging strategies to align with these preferences, potentially influencing purchasing decisions.

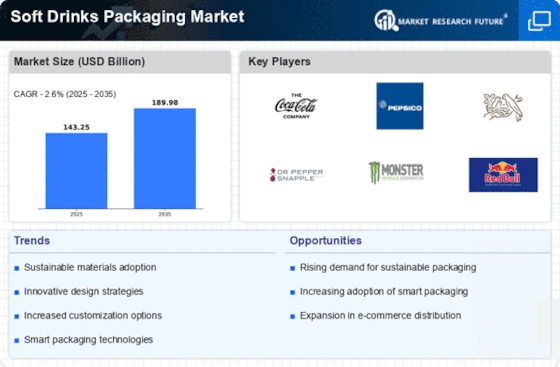

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver in the Soft Drinks Packaging Market. Consumers are becoming more environmentally conscious, leading to a demand for eco-friendly packaging solutions. Companies are responding by adopting biodegradable materials and recyclable packaging. In fact, a notable percentage of consumers express a preference for brands that utilize sustainable packaging. This shift not only aligns with consumer values but also helps companies reduce their carbon footprint. As a result, the industry is witnessing a surge in the development of innovative packaging solutions that minimize environmental impact. The integration of sustainable practices is likely to enhance brand loyalty and attract a broader customer base, thereby influencing market dynamics.

Technological Advancements

Technological advancements play a crucial role in shaping the Soft Drinks Packaging Market. Innovations such as smart packaging technologies are emerging, allowing for enhanced consumer engagement and product tracking. For instance, the incorporation of QR codes and NFC technology enables brands to provide consumers with real-time information about product origins and nutritional content. This trend not only improves transparency but also fosters trust between consumers and brands. Furthermore, advancements in production techniques are leading to more efficient packaging processes, reducing costs and waste. As technology continues to evolve, it is expected that the industry will see further enhancements in packaging design and functionality, potentially transforming consumer experiences.