Top Industry Leaders in the North America Smart HVAC Systems Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the North America Smart Hvac Systems industry are:

Johnson Controls International PLC

Daikin Industries Ltd

Lennox International Inc.

Electrolux AB

Emerson Electric Co.

Carrier Corporation

Rheem Manufacturing Company Inc.

Uponor Corp.

Ingersoll Rand Inc. (Trane Inc.)

Nortek Global HVAC, LLC

Bridging the Gap by Exploring the Competitive Landscape of the North America Smart Hvac Systems Top Players

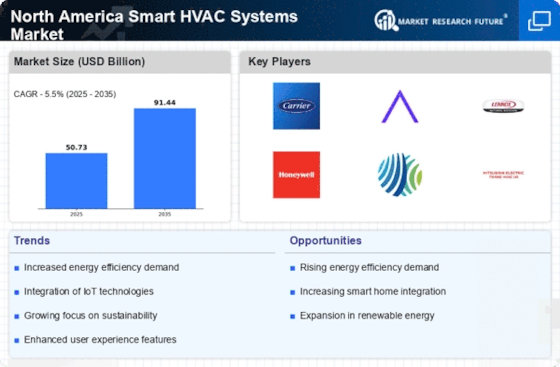

The North American smart HVAC systems market is a bustling arena fueled by surging energy efficiency demands, smart home integration, and rising consumer awareness. In this dynamic landscape, established players and new entrants alike are vying for dominance, employing diverse strategies and capitalizing on emerging trends to secure market share.

Key Players and Their Strategies:

- Legacy HVAC giants: Companies like Johnson Controls, Lennox International, and Carrier Corporation leverage their established brand recognition, extensive distribution networks, and R&D expertise to offer comprehensive smart HVAC solutions. They focus on product diversification, integrating advanced features like AI-powered climate control and voice-activated commands.

- Tech-savvy newcomers: Google Nest, Ecobee, and Honeywell are disrupting the market with their user-friendly thermostats and mobile apps, offering seamless integration with smart home ecosystems and data-driven insights for optimized energy usage. These players emphasize affordability and ease of installation, targeting tech-savvy millennials and early adopters.

- E-commerce giants: Amazon and Walmart are leveraging their online reach and logistics prowess to offer competitively priced smart HVAC systems from various brands. They also provide installation services and financing options, making smart technology accessible to a broader consumer base.

Factors for Market Share Analysis:

- Product portfolio: Offering a diverse range of smart HVAC systems catering to different residential and commercial needs, including single-split units, VRF systems, and chillers, is crucial for market share dominance.

- Technological innovation: Continuously investing in R&D to develop advanced features like AI-powered predictive maintenance, remote diagnostics, and hyper-local weather optimization is key to staying ahead of the curve.

- Brand reputation: Building trust through strong customer service, reliable products, and data security measures is essential for attracting and retaining customers in a competitive market.

- Strategic partnerships: Collaborating with smart home platform providers, energy providers, and construction companies can expand reach and offer integrated solutions to diverse customer segments.

- Pricing and affordability: Striking a balance between offering feature-rich products at competitive prices is crucial for attracting budget-conscious consumers and expanding market penetration.

New and Emerging Trends:

- Hyper-personalization: Smart HVAC systems are becoming increasingly personalized, learning individual preferences and automatically adjusting settings for optimal comfort and energy efficiency.

- Integration with health and wellness: Integration with wearables and smart home devices allows for personalized temperature adjustments based on occupant health and activity levels.

- Focus on sustainability: Eco-friendly features like solar-powered HVAC systems and demand response capabilities are gaining traction as consumers prioritize environmental consciousness.

- Voice-activated control: Voice assistants like Alexa and Google Assistant are becoming the preferred interface for controlling smart HVAC systems, promoting hands-free convenience.

Overall Competitive Scenario:

The North American smart HVAC market is fragmented but rapidly consolidating. While established players hold significant market share, tech-savvy newcomers and e-commerce giants are challenging their dominance with innovative offerings and competitive pricing. The market is characterized by intense competition, with players focusing on product differentiation, strategic partnerships, and continuous innovation to secure their position. Success in this dynamic market will depend on adaptability, a keen understanding of customer needs, and the ability to leverage emerging trends to offer comprehensive, user-friendly, and sustainable smart HVAC solutions.

Latest Company Updates:

Johnson Controls International PLC:

- Q3 2023 Earnings (Aug 02, 2023): Reported strong revenue and EPS growth, beating analyst estimates. Organic revenue grew 10% year-over-year, driven by continued growth in the Install business (including low double-digit growth in both retrofit and new construction). Updated FY23 guidance to ~+HSD organic revenue growth and adjusted EPS of ~$3.55, representing ~18% growth year-over-year. (Source: Johnson Controls press release)

Daikin Industries Ltd:

- North American Focus: Increased focus on the North American market, investing in production facilities and distribution networks. Recently announced a $400 million expansion of its manufacturing plant in Texas. (Source: Daikin press release)

Lennox International Inc.:

- Smart Home Integration: Partnering with leading smart home platforms like Alexa and Google Assistant to integrate its smart HVAC systems. Launched the Lennox ComfortSense™ smart thermostat with advanced comfort features and mobile app control. (Source: Lennox press release)