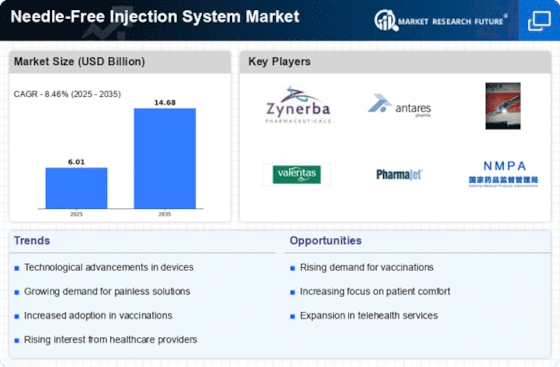

Patient-Centric Healthcare Trends

The Needle-Free Injection System Market is increasingly shaped by the shift towards patient-centric healthcare solutions. As patients become more involved in their own care, there is a growing demand for devices that enhance comfort and ease of use. Needle-free injectors align with this trend by providing a less invasive alternative to traditional syringes, thereby improving the overall patient experience. Market Research Future indicates that patient satisfaction is a key driver of healthcare decisions, and the adoption of needle-free systems is likely to enhance compliance among patients who are apprehensive about needles. This focus on patient-centricity is expected to drive innovation and investment in the Needle-Free Injection System Market, as manufacturers strive to meet the evolving needs of consumers.

Rising Focus on Vaccination Programs

The Needle-Free Injection System Market is benefiting from an intensified focus on vaccination programs worldwide. Governments and health organizations are prioritizing immunization efforts to combat infectious diseases, which has led to an increased demand for efficient delivery systems. Needle-free injectors are particularly advantageous in vaccination campaigns, as they minimize the risk of needle-related injuries and enhance the speed of administration. Recent data suggests that The Needle-Free Injection System is expected to reach USD 50 billion by 2026, with needle-free systems playing a crucial role in this growth. The convenience and safety offered by these systems are likely to encourage their adoption in mass immunization efforts, thereby propelling the Needle-Free Injection System Market forward. This trend indicates a promising future for needle-free technologies in public health initiatives.

Regulatory Support and Market Expansion

The Needle-Free Injection System Market is witnessing favorable regulatory support that facilitates market expansion. Regulatory bodies are increasingly recognizing the benefits of needle-free technologies, leading to streamlined approval processes for new devices. This supportive environment encourages innovation and investment in the development of advanced needle-free systems. Additionally, funding initiatives aimed at promoting safer injection practices are likely to bolster market growth. As healthcare systems worldwide seek to reduce the incidence of needle-stick injuries and improve patient safety, the demand for needle-free injectors is expected to rise. The combination of regulatory support and a growing awareness of the advantages of needle-free technologies positions the Needle-Free Injection System Market for robust growth in the coming years.

Increasing Prevalence of Chronic Diseases

The Needle-Free Injection System Market is significantly influenced by the rising prevalence of chronic diseases, such as diabetes and cardiovascular disorders. As these conditions require regular medication administration, the demand for efficient and painless delivery methods is escalating. Needle-free systems offer a viable solution, allowing for self-administration of medications without the discomfort associated with traditional needles. Reports indicate that the global burden of chronic diseases is expected to rise, with diabetes cases projected to reach 700 million by 2045. This growing patient population is likely to drive the adoption of needle-free technologies, as healthcare providers seek to improve patient adherence and outcomes. Consequently, the Needle-Free Injection System Market is poised for substantial growth as it aligns with the needs of an increasingly health-conscious society.

Technological Innovations in Needle-Free Injection Systems

The Needle-Free Injection System Market is experiencing a surge in technological innovations that enhance the efficacy and safety of drug delivery. Recent advancements in microfluidics and jet injection technologies have led to the development of devices that can deliver vaccines and medications without the need for needles. This shift not only reduces the risk of needle-stick injuries but also improves patient compliance, particularly among those with needle phobia. According to industry reports, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by these technological advancements. Furthermore, the integration of smart technologies, such as IoT-enabled devices, is likely to facilitate real-time monitoring and data collection, thereby enhancing the overall patient experience in the Needle-Free Injection System Market.