Focus on Preventive Healthcare

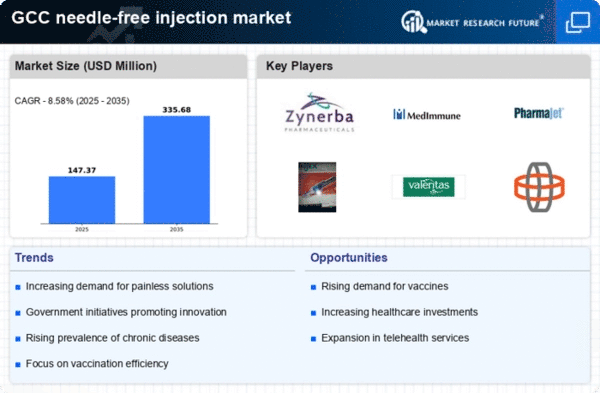

The growing emphasis on preventive healthcare is influencing the needle free-injection market positively. In the GCC, healthcare providers are increasingly prioritizing vaccination and early disease detection, which necessitates efficient and patient-friendly delivery methods. The needle free-injection market is likely to thrive as these methods align with the goals of preventive healthcare strategies. With a projected market growth of 10% annually, the adoption of needle free technologies is seen as a means to enhance public health initiatives. Furthermore, the convenience and reduced pain associated with these systems encourage higher participation rates in vaccination programs, thereby supporting the overall healthcare objectives of the region.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure are significantly impacting the needle free-injection market. In the GCC, various health ministries are allocating funds to promote advanced medical technologies, including needle free systems. This support is crucial for enhancing vaccination rates and managing chronic diseases effectively. For instance, recent budgets have earmarked millions of $ for the adoption of innovative healthcare solutions, which is likely to bolster the needle free-injection market. Additionally, public health campaigns advocating for pain-free vaccination methods are gaining traction, further driving market growth. As a result, the needle free-injection market is expected to benefit from increased government backing and funding in the coming years.

Rising Demand for Pain-Free Solutions

The needle free-injection market is experiencing a notable surge in demand for pain-free medical solutions. Patients increasingly prefer methods that minimize discomfort, particularly in chronic disease management and vaccination programs. This shift is evident in the GCC, where healthcare providers are adopting needle free technologies to enhance patient experience. The market is projected to grow at a CAGR of approximately 15% over the next five years, driven by this demand. Furthermore, the increasing prevalence of needle phobia among patients is prompting healthcare systems to explore alternatives that ensure compliance and improve health outcomes. As a result, the needle free-injection market is likely to expand significantly, catering to the needs of a more health-conscious population.

Increasing Incidence of Chronic Diseases

The rising incidence of chronic diseases in the GCC is a significant driver for the needle free-injection market. Conditions such as diabetes and cardiovascular diseases require regular medication, and needle free systems offer a more convenient and less painful alternative for patients. The market is anticipated to grow by approximately 14% over the next few years, as healthcare providers seek to improve adherence to treatment regimens. Additionally, the increasing burden of chronic diseases is prompting healthcare systems to adopt innovative solutions that enhance patient compliance and satisfaction. Consequently, the needle free-injection market is likely to expand as it addresses the needs of a growing population with chronic health issues.

Technological Innovations in Delivery Systems

Technological advancements are playing a crucial role in shaping the needle free-injection market. Innovations such as jet injectors and micro-needle systems are enhancing the efficacy and safety of drug delivery. In the GCC, these technologies are being integrated into healthcare practices, leading to improved patient outcomes and operational efficiencies. The market is expected to witness a growth rate of around 12% annually, as healthcare facilities invest in modernizing their delivery systems. These innovations not only reduce the risk of needle-stick injuries but also facilitate the administration of vaccines and biologics in a more efficient manner. Consequently, the needle free-injection market is poised for substantial growth as technology continues to evolve.