North America : Tech-Driven Market Growth

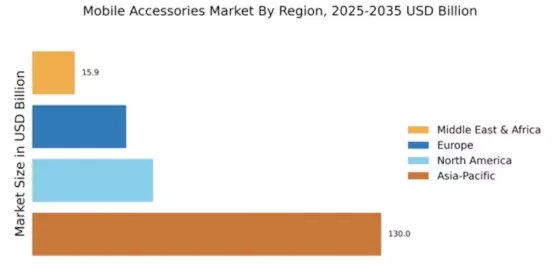

The North American mobile accessories market is projected to reach $45.0 billion by December 2025, driven by increasing smartphone penetration and consumer demand for high-quality accessories. Regulatory support for technology innovation and sustainability initiatives further catalyze market growth. The region's focus on advanced technology adoption and consumer electronics trends is expected to sustain this upward trajectory. The region dominates global mobile accessories production and demand. Leading countries like the US and Canada dominate the market, with key players such as Apple, Belkin, and OtterBox establishing a strong presence. The competitive landscape is characterized by innovation and premium product offerings, catering to a tech-savvy consumer base. The market is also witnessing collaborations and partnerships among manufacturers to enhance product portfolios and meet evolving consumer preferences. Local brands expand rapidly within the mobile accessories market.

Europe : Diverse Market with Strong Players

Europe's mobile accessories market is expected to reach $35.0 billion by December 2025, fueled by a diverse consumer base and increasing smartphone penetration. The region benefits from stringent regulations promoting product safety and sustainability, which are becoming key factors in consumer purchasing decisions. The demand for eco-friendly products is also on the rise, aligning with European Union directives on environmental standards. Germany, France, and the UK are leading countries in this market, with significant contributions from brands like Sony and Logitech. The competitive landscape is marked by a mix of established companies and emerging startups, all vying for market share. As consumers become more tech-savvy, the demand for high-quality, innovative accessories continues to grow, pushing companies to enhance their offerings and marketing strategies.

Asia-Pacific : Dominating Global Market Share

The Asia-Pacific region is the largest market for mobile accessories, projected to reach $130.0 billion by December 2025. This growth is driven by rapid urbanization, increasing disposable incomes, and a high penetration of smartphones. The region's regulatory environment is also evolving, with governments promoting technology adoption and innovation, which further fuels market expansion. The demand for diverse and affordable mobile accessories is particularly strong in emerging economies. China, Japan, and South Korea are the leading countries in this market, with major players like Samsung and Anker at the forefront. The competitive landscape is intense, characterized by a mix of global brands and local manufacturers. As consumer preferences shift towards multifunctional and stylish accessories, companies are focusing on innovation and customization to capture market share, ensuring a robust growth trajectory.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa (MEA) mobile accessories market is projected to reach $15.86 billion by December 2025, driven by increasing smartphone adoption and a young, tech-savvy population. The region is witnessing a surge in demand for mobile accessories, particularly in urban areas, where consumers are looking for enhanced functionality and style. Regulatory frameworks are gradually improving, supporting market growth and encouraging foreign investment in the technology sector. Leading countries in this region include South Africa, UAE, and Nigeria, where local and international brands are competing for market share. Key players like JBL and Bose are establishing a presence, while local manufacturers are also emerging. The competitive landscape is evolving, with a focus on affordability and quality, as consumers seek value in their purchases, making this an attractive market for investment.