Emergence of Smart Cities

The development of smart cities is a crucial factor propelling the Millimeter Wave Technology Market. As urban areas evolve into smart ecosystems, the need for efficient communication networks becomes paramount. Millimeter wave technology, with its ability to support high-capacity data transmission, is well-suited for smart city applications such as traffic management, public safety, and environmental monitoring. Reports suggest that investments in smart city initiatives are expected to exceed 1 trillion USD by 2025, creating a substantial opportunity for millimeter wave technology. The integration of this technology into urban infrastructure is likely to enhance connectivity and improve the quality of life for residents, thereby driving market growth.

Advancements in Consumer Electronics

The Millimeter Wave Technology Market is experiencing a notable boost due to advancements in consumer electronics. Devices such as smartphones, tablets, and wearables are increasingly incorporating millimeter wave technology to enhance connectivity and performance. The market for millimeter wave-enabled consumer electronics is anticipated to grow significantly, with projections indicating a compound annual growth rate of over 20% through 2025. This trend is driven by consumer demand for high-speed internet access and seamless connectivity. As manufacturers continue to innovate and integrate millimeter wave technology into their products, the industry is likely to witness a substantial increase in adoption rates, further solidifying its position in the market.

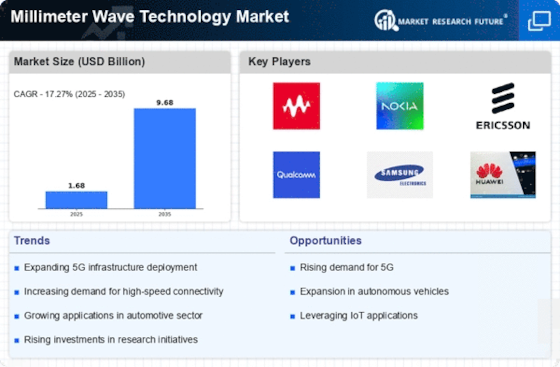

Increasing Adoption of 5G Technology

The rise of 5G technology is a pivotal driver for the Millimeter Wave Technology Market. As telecommunications companies roll out 5G networks, the demand for millimeter wave technology, which offers high data rates and low latency, is expected to surge. According to recent estimates, the 5G millimeter wave segment is projected to reach a market size of approximately 50 billion USD by 2026. This growth is fueled by the need for enhanced mobile broadband services and the proliferation of IoT devices. The integration of millimeter wave technology into 5G infrastructure is likely to facilitate faster data transmission, thereby transforming various sectors, including healthcare, entertainment, and smart cities.

Rising Demand for High-Resolution Imaging

The demand for high-resolution imaging systems is another significant driver of the Millimeter Wave Technology Market. Industries such as healthcare, automotive, and security are increasingly utilizing millimeter wave technology for imaging applications, including medical diagnostics and surveillance. The market for millimeter wave imaging systems is expected to grow substantially, with estimates suggesting a value of over 2 billion USD by 2026. This growth is driven by the need for enhanced imaging capabilities that can provide detailed information in real-time. As technology continues to advance, the integration of millimeter wave technology into imaging systems is likely to improve accuracy and efficiency, further propelling market expansion.

Growth in Aerospace and Defense Applications

The aerospace and defense sectors are increasingly recognizing the advantages of millimeter wave technology, which is driving the Millimeter Wave Technology Market. Applications such as radar systems, satellite communications, and secure data transmission are becoming more reliant on millimeter wave frequencies. The market for millimeter wave technology in aerospace and defense is projected to grow at a compound annual growth rate of around 15% over the next few years. This growth is attributed to the need for advanced communication systems that can operate in challenging environments. As defense budgets increase and the demand for sophisticated technology rises, the adoption of millimeter wave technology in these sectors is likely to expand.