Expanding Applications of Microsurgery

The expanding applications of microsurgery across various medical fields are driving growth in the Global Microsurgery and Super-Microsurgery Market. Originally utilized primarily in reconstructive surgery, microsurgical techniques are now being applied in areas such as neurosurgery, orthopedics, and even transplantation. This diversification of applications suggests a broader acceptance and integration of microsurgery into standard medical practices. For instance, the use of microsurgical techniques in nerve repair and vascular anastomosis is becoming increasingly common, reflecting a shift towards more specialized surgical approaches. As the medical community continues to recognize the benefits of microsurgery, the market is likely to see sustained growth, fueled by the demand for innovative surgical solutions across various disciplines.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases globally is a critical driver for the Global Microsurgery and Super-Microsurgery Market. Conditions such as diabetes, cardiovascular diseases, and cancer often necessitate complex surgical interventions, which microsurgery can effectively address. For instance, the World Health Organization reports that chronic diseases account for approximately 70% of all deaths worldwide, highlighting the urgent need for advanced surgical solutions. As healthcare systems adapt to manage these conditions, the demand for specialized microsurgical techniques is likely to increase. This trend suggests a robust market potential, as healthcare providers seek to implement innovative surgical methods to improve patient outcomes and reduce the burden of chronic illnesses.

Rising Investment in Healthcare Infrastructure

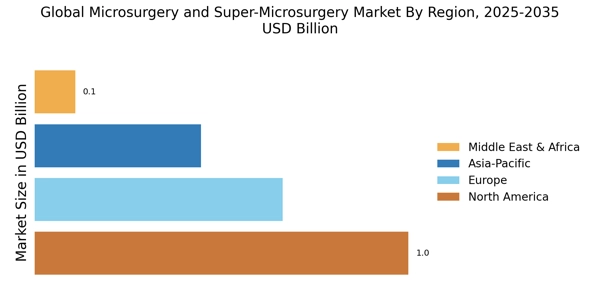

Investment in healthcare infrastructure is a pivotal factor propelling the Global Microsurgery and Super-Microsurgery Market. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, particularly in developing regions. This investment often includes the acquisition of advanced surgical equipment and training for healthcare professionals in microsurgical techniques. As a result, the availability of state-of-the-art surgical services is improving, which is likely to increase patient access to microsurgery. Furthermore, enhanced healthcare infrastructure can lead to better patient outcomes, fostering trust in surgical procedures. This trend indicates a promising future for the microsurgery market, as improved facilities are expected to attract more patients seeking specialized surgical care.

Technological Innovations in Surgical Techniques

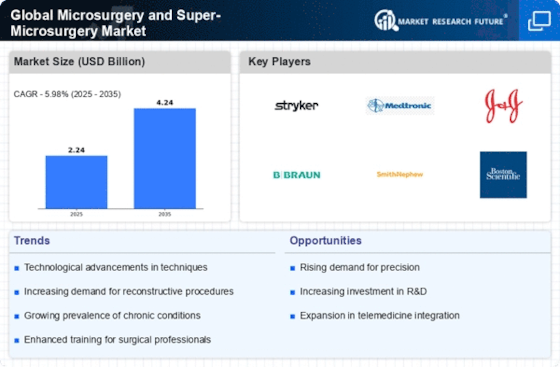

The Global Microsurgery and Super-Microsurgery Market is experiencing a surge in technological innovations that enhance surgical precision and outcomes. Advanced imaging techniques, such as 3D visualization and augmented reality, are being integrated into microsurgical procedures, allowing surgeons to operate with greater accuracy. Furthermore, the development of robotic-assisted surgical systems is revolutionizing the field, enabling minimally invasive approaches that reduce recovery times and improve patient satisfaction. According to recent data, the market for surgical robots is projected to grow significantly, indicating a strong trend towards automation in surgery. These innovations not only improve surgical efficacy but also expand the range of procedures that can be performed, thereby driving growth in the microsurgery sector.

Growing Aesthetic and Reconstructive Surgery Demand

The Global Microsurgery and Super-Microsurgery Market is significantly influenced by the increasing demand for aesthetic and reconstructive surgeries. As societal perceptions of beauty evolve, more individuals are seeking cosmetic enhancements, which often require microsurgical techniques. Additionally, reconstructive surgeries for trauma victims or those with congenital defects are becoming more prevalent, driven by advancements in surgical methods. Market data indicates that the aesthetic surgery segment is expected to witness substantial growth, with procedures such as breast reconstruction and facial rejuvenation leading the way. This growing consumer interest in both aesthetic and reconstructive options is likely to propel the demand for microsurgical services, thereby expanding the market.