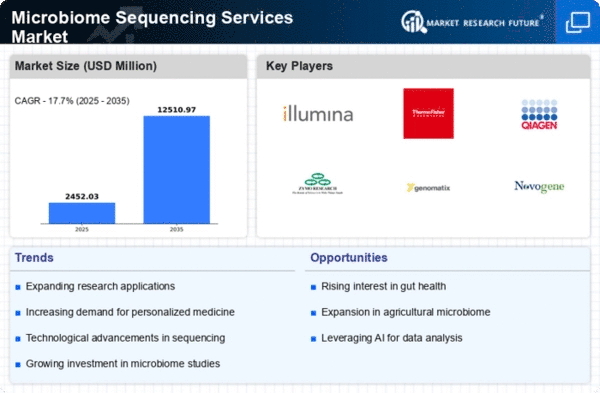

Market Growth Projections

The Global Microbiome Sequencing Services Market Industry is projected to witness substantial growth over the coming years. The market is expected to reach 2.08 USD Billion in 2024 and is forecasted to expand to 11.7 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 16.99% from 2025 to 2035. Such projections indicate a robust demand for microbiome sequencing services, driven by advancements in technology, increased research funding, and a growing consumer focus on health and wellness.

Increased Research Funding

The Global Microbiome Sequencing Services Market Industry benefits from increased funding for microbiome research from both public and private sectors. Governments and research institutions are recognizing the potential of microbiome studies in various fields, including medicine, agriculture, and environmental science. This influx of funding is facilitating large-scale studies and collaborations, thereby expanding the scope of microbiome research. As a result, the demand for sequencing services is expected to rise, contributing to a compound annual growth rate of 16.99% from 2025 to 2035.

Growing Awareness of Gut Health

There is a growing awareness of the importance of gut health among consumers, which is significantly influencing the Global Microbiome Sequencing Services Market Industry. As individuals become more informed about the link between gut microbiota and overall health, they are increasingly seeking microbiome testing services. This trend is reflected in the rising number of companies offering consumer-oriented microbiome sequencing services. The increasing consumer demand for gut health insights is likely to drive market expansion, as more individuals seek personalized recommendations based on their microbiome profiles.

Advancements in Sequencing Technologies

Technological advancements in sequencing methodologies are propelling the Global Microbiome Sequencing Services Market Industry forward. Innovations such as next-generation sequencing (NGS) and single-cell sequencing are enhancing the accuracy and efficiency of microbiome analysis. These technologies enable researchers and clinicians to obtain comprehensive microbial profiles, which are essential for understanding complex interactions within the microbiome. As these technologies continue to evolve, they are likely to attract more investments and drive market growth, potentially leading to a market size of 11.7 USD Billion by 2035.

Rising Demand for Personalized Medicine

The Global Microbiome Sequencing Services Market Industry is experiencing a notable increase in demand for personalized medicine. This trend is largely driven by the growing recognition of the microbiome's role in health and disease. As healthcare providers seek to tailor treatments based on individual microbiome profiles, the market is projected to reach 2.08 USD Billion in 2024. This shift towards personalized healthcare solutions indicates a significant opportunity for microbiome sequencing services, as they provide critical insights that can enhance therapeutic efficacy and patient outcomes.

Regulatory Support for Microbiome Research

Regulatory bodies are increasingly supporting microbiome research, which is positively impacting the Global Microbiome Sequencing Services Market Industry. Initiatives aimed at promoting microbiome studies and establishing guidelines for microbiome-based products are fostering a conducive environment for innovation. This regulatory support not only encourages research but also enhances public trust in microbiome-related products and services. As regulations evolve, they may facilitate market entry for new players and technologies, further stimulating growth in the microbiome sequencing services sector.