Supportive Regulatory Environment

A supportive regulatory environment in the UK is fostering growth in the microbiome sequencing-services market. Regulatory bodies are increasingly recognizing the importance of microbiome research and are establishing guidelines that facilitate innovation and ensure safety. This environment encourages investment in microbiome-related research and development, which is crucial for the advancement of sequencing technologies. The UK government has allocated £50 million to support microbiome research initiatives, indicating a commitment to enhancing the sector. Such support is likely to stimulate market growth as companies seek to comply with regulations while developing new services.

Increasing Awareness of Gut Health

The rising awareness of gut health among the UK population is a pivotal driver for the microbiome sequencing-services market. As individuals become more informed about the connection between gut microbiota and overall health, there is a growing demand for services that can provide insights into personal microbiomes. This trend is reflected in the increasing number of consumers seeking microbiome testing to understand their digestive health, which is projected to grow at a CAGR of 15% over the next five years. The microbiome sequencing services market is positioned to benefit from this heightened interest. Consumers are looking for tailored solutions to improve their health outcomes.

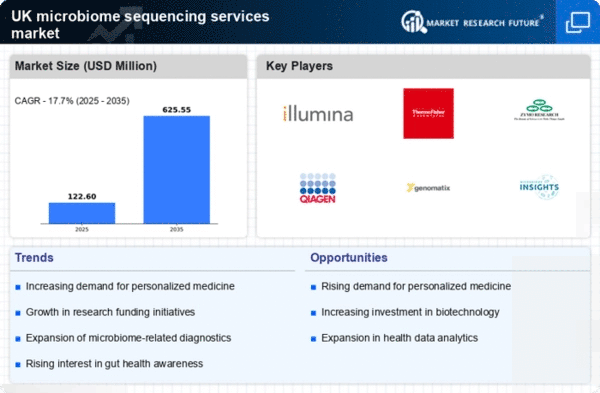

Rising Investment in Biotechnology

The microbiome sequencing services market is experiencing a surge in investment from both public and private sectors. This investment is a key driver of its growth. The UK biotechnology sector has seen increased funding, with venture capital investments reaching £1.5 billion in 2025. This influx of capital is enabling companies to innovate and expand their service offerings in microbiome sequencing. As more startups and established firms enter the market, competition is expected to intensify, leading to advancements in technology and service delivery. This trend suggests a robust future for the microbiome sequencing-services market as it attracts further investment.

Expansion of Healthcare Applications

The expansion of healthcare applications utilizing microbiome sequencing is significantly influencing the microbiome sequencing-services market. With advancements in understanding the role of microbiomes in various diseases, including obesity, diabetes, and autoimmune disorders, healthcare providers are increasingly integrating microbiome analysis into patient care. This integration is expected to enhance diagnostic accuracy and treatment efficacy, potentially increasing the market size by £200 million by 2027. As healthcare professionals recognize the value of microbiome data, the demand for sequencing services is likely to surge, driving growth in the market.

Growing Consumer Interest in Preventive Healthcare

The growing consumer interest in preventive healthcare is significantly impacting the microbiome sequencing-services market. As individuals become more proactive about their health, there is an increasing demand for services that provide insights into personal health risks and preventive measures. The market is projected to grow by 20% annually as consumers seek microbiome analysis to inform lifestyle choices and dietary adjustments. This shift towards preventive healthcare is likely to drive the adoption of microbiome sequencing services, as consumers look for ways to enhance their well-being and prevent potential health issues.