Market Share

Microbiome Sequencing Services Market Share Analysis

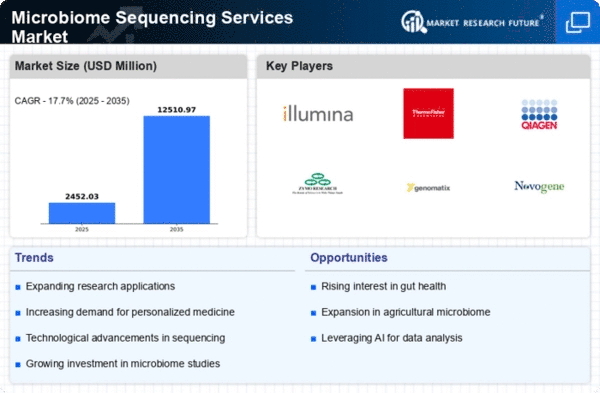

The Microbiome Sequencing Services are growing very quickly. Market studies the different bacteria communities in the human body. To become the leaders in high-quality, complete microbiome sequencing, these businesses use a variety of strategies to gain market share. To stay competitive in microbiome sequencing services, methods for sequencing must always be improved. Companies use NGS and metagenomics to learn more about microbe communities and attract customers who want the latest sequencing services. It makes sense to form good relationships. Universities, science companies, and pharmaceutical companies can use microbiome sequencing services to do study and come up with new medicines. Because they work together, their services get more respect and market share. There are a lot of different microbial study fields, so companies tailor their services to those areas. Firms can meet the needs of healthcare and university experts for gut health, skin bacteria, and outdoor microbiomes through customization. Businesses want to grow their global markets while also looking into microbiome studies in their own countries. By tailoring their services to the microbiomes and study goals of different regions, companies may be able to break into foreign markets and take over the global microbiome sequencing scene. It's not okay to mess up sequence data. Companies use strict quality control methods that follow the rules set by the government and the industry. These high standards help customers trust the company, which makes it a good choice for microbiome sequencing. A strategic edge can be gained from better genetic research. Bioinformatics systems are used by businesses to look at big amounts of microbiome data and give customers useful information. Researchers who study data are drawn to services that offer advanced analytics. It's important to have great customer service. Collaboration and advising services from companies help researchers plan studies, collect samples, and figure out what the results mean. This focus on the customer approach builds long-lasting relationships and improves the names of microbial sequencing service companies. Microbiome sequencing is taught to the public by businesses. Online tools, workshops, and seminars help spread information, which makes the company look like a guide and brings in clients who are looking for help. To reach the market, you need to do good marketing. Companies post study papers, white papers, and go to workshops to show that they are experts in microbiome sequencing. People looking for stars in their field want brands that they can trust and that lead the way in thinking. Companies keep up with studies on microbiomes. In microbiome science, companies change their services to fit new study questions and methods. This makes them look flexible and quick to act.

Leave a Comment