Top Industry Leaders in the Micro Mobility Market

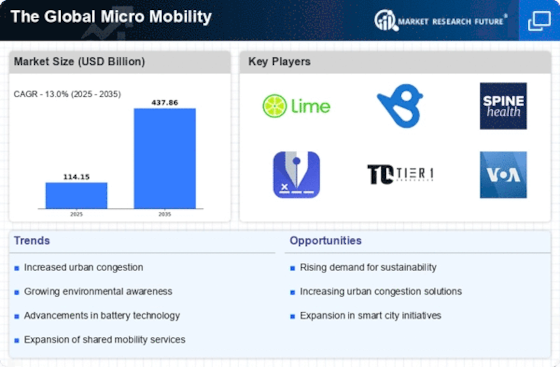

The micro-mobility market, encompassing e-scooters, e-bikes, and other compact electric vehicles for short-distance travel, is buzzing with activity. Fueled by growing urbanization, environmental concerns, and the need for convenient first- and last-mile transportation, this market is attracting diverse players with varied strategies.

Top Companies in the Micro Mobility industry includes,

Yellow Scooters (US)

Bird Rides Inc. (US)

Lime Scooter (US)

Micro Mobility Systems AG (Switzerland)

ofo Inc. (China)

Mobike (China)

Motivate (Lyft) (US)

Pride Mobility Products Corp. (US)

EV RIDER LLC (US)

Golden Technologies (US)

Merits Co. Ltd (Taiwan)

Invacare Corporation (US)

Segway, Inc. (US)

Ninebot Limited (China)

Lime Electric Bikes and Scooters (US)

Scoot Networks (US)

Uber Technologies Inc. (US)

Lyft Inc. (US)

TIER Mobility GmbH (Germany), and others.

Key Player Strategies:

Tech Giants: Companies like Bird, Lime, and Uber (Jump) leverage their technology expertise and app-based platforms to dominate the shared e-scooter market. They focus on scalability, rapid deployment, and data-driven operations to optimize fleet management and rider experience.

Traditional Bike Manufacturers: Established players like Giant, Specialized, and Trek are entering the micro-mobility space with high-quality e-bikes and e-scooters. They capitalize on their brand reputation, existing distribution networks, and focus on premium materials and performance for individual ownership.

Startup Disruptors: Startups like Voi, Tier, and Dott are challenging the established players with innovative features like dockless e-bikes, swappable batteries, and integrated safety technologies. They cater to tech-savvy users and focus on user-friendliness and sustainability.

Public Transportation Integration: Cities and public transport authorities are increasingly partnering with micro-mobility providers to offer integrated ticketing and seamless connections between different modes of transportation. This collaboration fosters a more comprehensive urban mobility ecosystem.

Factors for Market Share Analysis:

Geographic Footprint and Scalability: The ability to quickly expand into new cities and manage large fleets efficiently is crucial for success in the shared micro-mobility market. Companies with strong operational capabilities and strategic partnerships gain an edge.

Product Portfolio and Innovation: Offering a diverse range of e-scooters, e-bikes, and other micro-mobility options catering to different needs and preferences (e.g., commuting, leisure, cargo) attracts a wider customer base. Companies investing in R&D for improved range, safety features, and user experience stand out.

Pricing and Affordability: Balancing competitive pricing with profitability is crucial for attracting riders and ensuring long-term business sustainability. Companies offering flexible pricing options and subscription models cater to diverse budgets.

Safety and Regulatory Compliance: Ensuring rider and pedestrian safety through robust training programs, geofencing technology, and adherence to local regulations is paramount. Companies prioritizing safety and responsible operations build trust and secure regulatory approvals.

New and Emerging Trends:

Micromobility Integration with Public Transportation: Seamless integration of e-scooters and e-bikes with public transit systems through docking stations, shared ticketing, and real-time information sharing promotes multi-modal journeys and reduces car dependency.

Focus on Sustainability: Utilizing sustainable materials, promoting battery recycling, and offsetting carbon emissions are gaining traction. Companies demonstrating environmental consciousness attract eco-conscious riders and investors.

E-cargo Bikes for Last-Mile Delivery: E-cargo bikes are emerging as a sustainable and efficient solution for last-mile delivery in urban areas. Companies offering cargo bikes and delivery services cater to businesses seeking eco-friendly and cost-effective solutions.

Subscription Models and Micro-mobility Ownership: Shifting from shared models to subscription-based ownership of e-scooters and e-bikes is a potential trend, particularly for individual commuters seeking personal mobility options.

Overall Competitive Scenario:

The micro-mobility market is a dynamic and evolving space with a diverse range of players competing for market share. Tech giants leverage their tech expertise and app-based platforms, traditional bike manufacturers capitalize on their brand and quality, startups disrupt with innovative features, and public authorities collaborate for integrated solutions. Geographic footprint, product portfolio, affordability, and safety compliance are key factors for market share analysis. New trends like public transport integration, sustainability focus, e-cargo bikes, and subscription models offer exciting growth opportunities. To succeed in this competitive landscape, players must adapt to evolving trends, cater to diverse user needs, prioritize safety and sustainability, and embrace technological innovation.

Industry Developments and Latest Updates:

-

Uber Technologies Inc.: Invested in micromobility startup Voi Technology in July 2023, expanding its micromobility offerings. (Source: Reuters, July 20, 2023) -

ofo Inc.: Filed for bankruptcy in January 2023 due to financial difficulties. (Source: Bloomberg, January 12, 2023) -

Motivate (Lyft): Launched e-bike service in Washington D.C. in December 2023. (Source: Washington Post, December 12, 2023) -

Bird Rides Inc.: Raised $300 million in Series D funding in July 2023, expanding operations to 500 cities globally. (Source: Reuters, July 12, 2023)