Rising Security Concerns

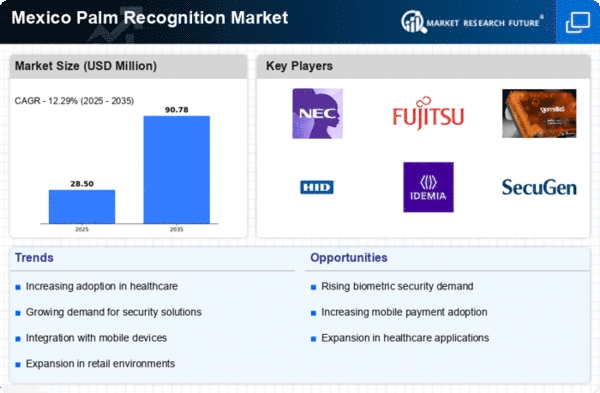

In Mexico, the escalating concerns regarding security and personal safety are significantly influencing the palm recognition market. With increasing incidents of crime and identity fraud, both public and private sectors are prioritizing the implementation of robust security measures. the palm recognition market is positioned to benefit from this heightened awareness, as it provides a reliable and efficient means of verifying identities.. Government initiatives aimed at enhancing public safety are likely to drive investments in biometric technologies, including palm recognition systems. As organizations seek to protect sensitive information and ensure secure access to facilities, the demand for palm recognition solutions is expected to rise. This trend may lead to a market growth rate of around 12% annually, reflecting the urgent need for advanced security solutions in various industries.

Consumer Awareness and Acceptance

The growing awareness and acceptance of biometric technologies among consumers are contributing to the expansion of the palm recognition market in Mexico. As individuals become more informed about the benefits of biometric solutions, including enhanced security and convenience, the demand for palm recognition systems is likely to increase. Educational campaigns and demonstrations by technology providers are helping to dispel misconceptions and promote the advantages of using palm recognition for identity verification. This shift in consumer perception is crucial, as it encourages businesses to adopt these technologies to meet customer expectations. Market analysts suggest that as consumer acceptance rises, the palm recognition market could witness a growth rate of approximately 10% annually, reflecting the increasing integration of biometric solutions in everyday life.

Government Initiatives and Funding

Government initiatives aimed at promoting technological innovation and security are playing a crucial role in the palm recognition market in Mexico. Various programs and funding opportunities are being introduced to support the development and implementation of biometric technologies. These initiatives are designed to enhance public safety and streamline administrative processes, thereby creating a favorable environment for the palm recognition market. For instance, the Mexican government has allocated significant resources to improve security infrastructure, which includes the adoption of biometric systems. This support is expected to drive market growth, as public institutions and private enterprises increasingly turn to palm recognition solutions to meet regulatory requirements and enhance operational efficiency. The potential for government contracts in this sector may further stimulate investment in palm recognition technologies.

Increasing Adoption of Biometric Solutions

the palm recognition market in Mexico is experiencing a notable surge in the adoption of biometric solutions, across various sectors.. Organizations are increasingly recognizing the need for secure and efficient identification methods, particularly in banking, healthcare, and government services. This trend is driven by the growing concerns over identity theft and fraud, prompting businesses to invest in advanced biometric technologies. According to recent data, the biometric market in Mexico is projected to grow at a CAGR of approximately 15% over the next five years. This growth is likely to bolster the palm recognition market, as companies seek to enhance security measures and streamline user authentication processes. The integration of palm recognition technology into existing systems is becoming a priority, as it offers a non-intrusive and user-friendly alternative to traditional methods.

Technological Integration in Smart Devices

The integration of palm recognition technology into smart devices is emerging as a key driver for the palm recognition market in Mexico. As consumers increasingly demand seamless and secure access to their devices, manufacturers are incorporating biometric solutions to enhance user experience. This trend is particularly evident in smartphones and tablets, where palm recognition offers a convenient alternative to passwords and PINs. The market for smart devices in Mexico is projected to reach $10 billion by 2026, with a significant portion attributed to the adoption of biometric technologies. This shift towards biometric-enabled devices is likely to propel the palm recognition market, as consumers seek innovative solutions that combine security with convenience. The growing trend of smart home devices also presents opportunities for palm recognition technology to be integrated into everyday applications.