Rising Consumer Awareness

Consumer awareness regarding the benefits of biometric authentication is on the rise in Canada, positively impacting the palm recognition market. As individuals become more informed about the advantages of secure and convenient access methods, the demand for palm recognition solutions is expected to increase. This awareness is fueled by educational campaigns and the visibility of biometric technologies in everyday applications, such as mobile payments and secure access to personal devices. The palm recognition market may see a notable uptick in adoption rates as consumers prioritize security and convenience in their interactions with technology.

Increased Security Concerns

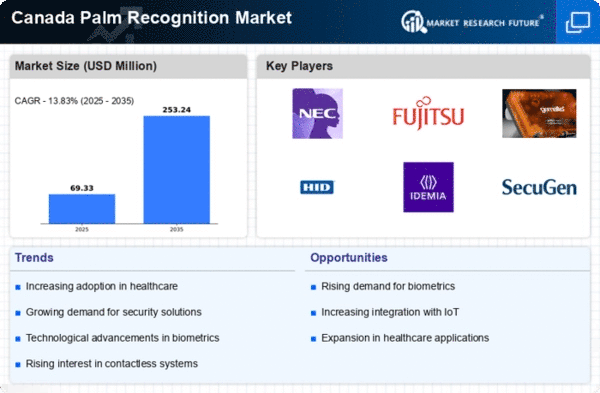

The palm recognition market in Canada is experiencing growth due to heightened security concerns across various sectors. Organizations are increasingly adopting biometric solutions to enhance security measures, particularly in sensitive environments such as financial institutions and government facilities. The need for robust authentication methods is underscored by rising incidents of identity theft and fraud. As a result, the palm recognition market is projected to expand, with estimates suggesting a compound annual growth rate (CAGR) of approximately 15% over the next five years. This trend indicates a strong demand for advanced biometric systems that can provide secure access while ensuring user convenience.

Growing Adoption in Healthcare

The healthcare sector in Canada is increasingly adopting palm recognition technology to streamline patient identification and enhance security protocols. Hospitals and clinics are recognizing the potential of biometric systems to reduce errors associated with patient misidentification, which can lead to serious consequences. The palm recognition market is poised to grow. This growth is due to healthcare facilities investing in these systems to improve operational efficiency and patient safety. With healthcare expenditures in Canada projected to reach $300 billion by 2026, the demand for reliable identification methods is likely to drive the adoption of palm recognition solutions in this sector.

Supportive Government Initiatives

Government initiatives aimed at promoting biometric technologies are contributing to the growth of the palm recognition market in Canada. Various programs and funding opportunities are being introduced to encourage the development and implementation of advanced security solutions. These initiatives are designed to enhance national security and improve public safety, thereby creating a favorable environment for the adoption of palm recognition systems. As the government invests in technology infrastructure, the palm recognition market is likely to benefit from increased funding and support, fostering innovation and expansion within the industry.

Integration with Smart Technologies

The integration of palm recognition technology with smart devices is driving innovation within the industry. As smart home and IoT devices proliferate, the demand for seamless and secure user authentication methods is increasing. This integration allows for enhanced user experiences, as palm recognition can facilitate quick access to devices and services. In Canada, the market for smart devices is expected to reach $10 billion by 2026, indicating a significant opportunity for palm recognition solutions to be embedded in these technologies. This trend suggests that the palm recognition market will likely benefit from the growing interconnectedness of devices.