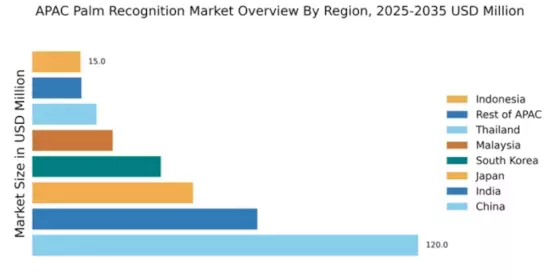

China : Unmatched Growth and Innovation

China holds a commanding market share of 120.0, representing a significant portion of the APAC palm recognition market. Key growth drivers include rapid urbanization, increasing security concerns, and government initiatives promoting biometric technology. The demand for palm recognition systems is surging in sectors like finance and healthcare, supported by favorable regulatory policies that encourage technological adoption. Infrastructure development, particularly in smart cities, further fuels this growth.

India : Rapid Adoption of Biometric Solutions

India's palm recognition market is valued at 70.0, driven by a growing emphasis on digital identity verification and security. The government's Digital India initiative promotes the use of biometric systems across various sectors, including banking and e-governance. Increasing smartphone penetration and urbanization are also contributing to rising demand. Regulatory frameworks are evolving to support biometric data protection, enhancing consumer trust.

Japan : Innovation and Security Integration

Japan's palm recognition market is valued at 50.0, characterized by advanced technological integration in security systems. The demand is driven by the need for enhanced security in public spaces and corporate environments. Government initiatives focus on promoting smart city projects, which incorporate biometric solutions. Regulatory policies are stringent, ensuring data privacy and security, which fosters consumer confidence in biometric technologies.

South Korea : Biometrics in Everyday Life

South Korea's palm recognition market is valued at 40.0, with significant growth driven by the integration of biometric systems in various sectors, including finance, healthcare, and retail. The government supports innovation through funding and regulatory frameworks that encourage the adoption of biometric technologies. Urban centers like Seoul are key markets, showcasing a competitive landscape with major players like NEC and Fujitsu leading the charge.

Malaysia : Biometric Adoption on the Rise

Malaysia's palm recognition market is valued at 25.0, with growth fueled by increasing security needs in both public and private sectors. Government initiatives, such as the National Cyber Security Policy, promote the adoption of biometric technologies. Demand is particularly strong in urban areas like Kuala Lumpur, where infrastructure development supports the integration of advanced security systems. Local players are emerging alongside global giants like HID Global.

Thailand : Focus on Security and Efficiency

Thailand's palm recognition market is valued at 20.0, driven by a growing focus on security in public services and private enterprises. The government is actively promoting biometric solutions through regulatory frameworks that enhance data protection. Key markets include Bangkok and Chiang Mai, where local businesses are increasingly adopting biometric systems. The competitive landscape features both local and international players, fostering innovation and growth.

Indonesia : Biometric Solutions Gaining Traction

Indonesia's palm recognition market is valued at 15.0, with growth driven by increasing awareness of security technologies. Government initiatives aimed at improving public safety are encouraging the adoption of biometric systems. Key cities like Jakarta are leading the way in demand, with local businesses exploring biometric solutions for various applications. The market is competitive, with both local startups and established players like IDEMIA making their mark.

Rest of APAC : Potential Across Multiple Sectors

The Rest of APAC palm recognition market is valued at 15.3, showcasing diverse growth opportunities across various countries. Demand is driven by increasing security needs and government initiatives promoting biometric technologies. Countries like Vietnam and the Philippines are emerging markets with significant potential. The competitive landscape includes both local and international players, with applications spanning finance, healthcare, and public safety.