Aging Population

Mexico's demographic shift towards an aging population is significantly influencing the dietary supplements market. With a growing number of individuals aged 60 and above, there is an increasing need for products that cater to age-related health concerns. This demographic is often more susceptible to chronic diseases and nutritional deficiencies, leading to a heightened interest in dietary supplements that support joint health, cognitive function, and cardiovascular health. It is estimated that by 2030, the elderly population in Mexico will account for over 20% of the total population, thereby expanding the market for dietary supplements tailored to this age group. The dietary supplements market is thus poised for growth as manufacturers develop targeted products to meet the specific needs of older consumers.

Growing Health Consciousness

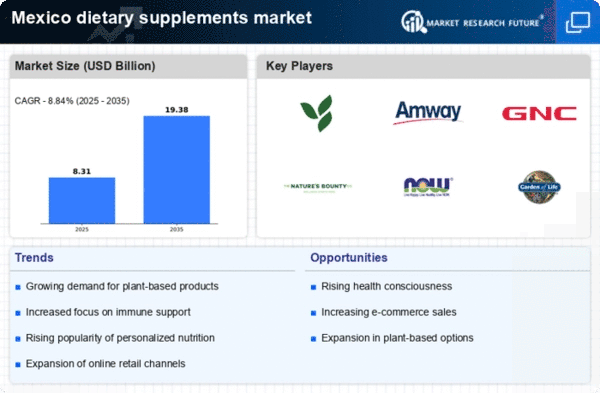

The increasing awareness of health and wellness among the Mexican population appears to be a primary driver for the dietary supplements market. As individuals become more informed about nutrition and its impact on overall health, the demand for dietary supplements is likely to rise. Reports indicate that approximately 60% of Mexicans actively seek ways to improve their health, which includes the consumption of vitamins, minerals, and herbal supplements. This trend is further supported by a shift towards preventive healthcare, where consumers prefer to invest in supplements to avoid potential health issues. The dietary supplements market is thus experiencing a surge in demand, particularly for products that promote immunity, energy, and overall well-being.

Regulatory Support and Quality Assurance

The Mexican government has been actively promoting the dietary supplements market through regulatory frameworks that ensure product safety and efficacy. The establishment of guidelines by the Federal Commission for the Protection against Sanitary Risk (COFEPRIS) has fostered consumer trust in dietary supplements. This regulatory support is crucial as it encourages manufacturers to adhere to quality standards, thereby enhancing the credibility of the dietary supplements market. As consumers become more discerning about product quality, the presence of stringent regulations is likely to drive growth in the market. Furthermore, the emphasis on quality assurance may lead to increased investment in research and development, resulting in innovative products that cater to evolving consumer preferences.

Rising Interest in Preventive Healthcare

The growing trend towards preventive healthcare is significantly impacting the dietary supplements market in Mexico. Consumers are increasingly recognizing the importance of maintaining health and preventing illness rather than solely treating conditions as they arise. This shift in mindset is driving demand for dietary supplements that support immune function, digestive health, and overall vitality. Market data indicates that the preventive healthcare segment is expected to grow by approximately 15% annually, reflecting a broader societal trend towards proactive health management. The dietary supplements market is thus benefiting from this paradigm shift, as consumers seek out products that align with their health goals and lifestyle choices.

Influence of Social Media and Digital Marketing

The rise of social media and digital marketing strategies is reshaping the dietary supplements market in Mexico. Brands are increasingly leveraging platforms like Instagram and Facebook to reach health-conscious consumers, particularly millennials and Generation Z. This demographic is known for its reliance on online information and peer recommendations when making purchasing decisions. As a result, the dietary supplements market is witnessing a shift towards more engaging and informative marketing campaigns that highlight product benefits and user testimonials. Data suggests that nearly 70% of young consumers in Mexico are influenced by social media when considering dietary supplements, indicating a potential for brands to expand their reach and enhance consumer engagement through digital channels.