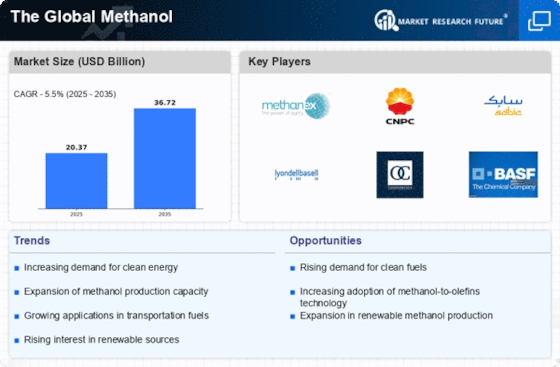

Increasing Demand for Clean Energy

The rising The Global Methanol Industry. As nations strive to reduce carbon emissions, methanol is increasingly recognized as a cleaner alternative to traditional fossil fuels. The International Energy Agency indicates that methanol can be utilized in fuel cells and as a transportation fuel, which may lead to a surge in demand. Furthermore, the transition towards renewable energy sources, such as wind and solar, often necessitates energy storage solutions where methanol can play a crucial role. This growing inclination towards sustainable energy sources is likely to bolster the market, as methanol's versatility positions it favorably in the evolving energy landscape.

Government Policies and Regulations

Government policies and regulations aimed at promoting cleaner fuels and reducing greenhouse gas emissions are likely to influence The Global Methanol Industry positively. Many countries are implementing stricter environmental regulations, which may encourage the adoption of methanol as a cleaner alternative to conventional fuels. Incentives for renewable energy and cleaner technologies could further stimulate methanol production and consumption. For example, some governments are providing subsidies for methanol fuel use in transportation, which may enhance its market penetration. As regulatory frameworks evolve, the methanol industry could benefit from increased support, potentially leading to a more robust market presence.

Diverse Applications Across Industries

The diverse applications of methanol across multiple industries serve as a substantial driver for The Global Methanol Industry. Methanol Market is utilized in the production of formaldehyde, acetic acid, and various chemicals, which are essential in manufacturing plastics, paints, and textiles. The chemical industry, in particular, has shown a consistent demand for methanol, with estimates suggesting that around 60% of methanol produced is converted into other chemicals. Additionally, the automotive sector is increasingly adopting methanol as a fuel alternative, which could further expand its market reach. This versatility in applications not only sustains demand but also positions methanol as a critical component in various industrial processes.

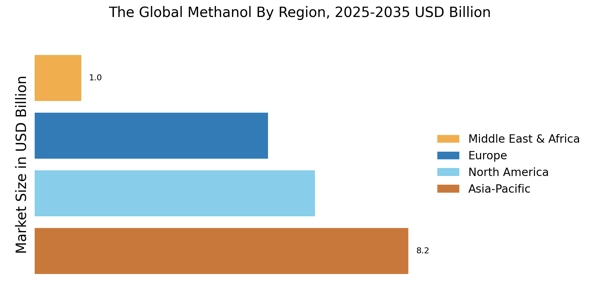

Expansion of Methanol Production Facilities

The expansion of methanol production facilities is a notable driver for The Global Methanol Industry. Recent investments in new production plants and the upgrading of existing facilities have been observed across various regions. For instance, the establishment of large-scale methanol plants in regions rich in natural gas, such as North America and the Middle East, has significantly increased production capacities. According to industry study, the global methanol report production capacity is projected to reach approximately 150 million metric tons by 2025. This increase in production capabilities not only meets the rising demand but also enhances the competitive landscape, potentially leading to lower prices and increased accessibility of methanol in various applications.

Technological Innovations in Production Processes

Technological innovations in methanol production processes are emerging as a significant driver for The Global Methanol Industry. Advances in catalytic processes and the development of more efficient production methods are likely to enhance yield and reduce costs. For instance, the adoption of new catalysts can improve the conversion rates of natural gas to methanol, making production more economically viable. Furthermore, innovations in carbon capture and utilization technologies may allow for the integration of renewable feedstocks, thereby reducing the carbon footprint of methanol production. These technological advancements not only promise to increase production efficiency but also align with the global shift towards sustainable manufacturing practices.