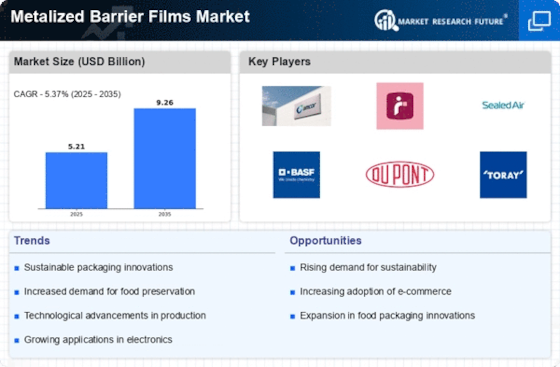

Growth in Food and Beverage Sector

The Metalized Barrier Films Market is significantly influenced by the expansion of the food and beverage sector. As consumer preferences shift towards packaged and processed foods, the demand for effective packaging solutions that preserve freshness and extend shelf life is on the rise. Metalized barrier films are particularly valued in this context due to their excellent moisture and oxygen barrier properties. Recent statistics indicate that the food packaging segment is expected to account for a substantial share of the overall market, with projections suggesting a growth rate of around 5% annually. This trend underscores the critical role that metalized barrier films play in ensuring product quality and safety, thereby driving their adoption within the Metalized Barrier Films Market.

Rising Demand for Flexible Packaging

The Metalized Barrier Films Market is experiencing a notable surge in demand for flexible packaging solutions. This trend is largely driven by the increasing consumer preference for lightweight and convenient packaging options. Flexible packaging not only enhances product shelf life but also reduces material waste, aligning with sustainability goals. According to recent data, the flexible packaging segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is indicative of a broader shift towards more adaptable packaging solutions that meet the evolving needs of consumers and manufacturers alike. As a result, the Metalized Barrier Films Market is poised to benefit significantly from this trend, as these films provide essential barrier properties while maintaining flexibility.

Expansion of E-commerce and Online Retail

The rapid expansion of e-commerce and online retail is significantly impacting the Metalized Barrier Films Market. As more consumers turn to online shopping, the demand for packaging that ensures product integrity during transit has intensified. Metalized barrier films are particularly suited for this purpose, as they provide robust protection against moisture, light, and oxygen, which are critical factors in maintaining product quality. Recent analyses indicate that the e-commerce packaging market is projected to grow at a compound annual growth rate of around 6% over the next few years. This growth presents a substantial opportunity for the Metalized Barrier Films Market, as businesses seek reliable packaging solutions that can withstand the rigors of shipping while appealing to environmentally conscious consumers.

Technological Innovations in Film Production

Technological advancements in the production of metalized barrier films are playing a crucial role in shaping the Metalized Barrier Films Market. Innovations such as improved coating techniques and enhanced metallization processes are leading to the development of films with superior barrier properties. These advancements not only enhance the performance of the films but also contribute to cost efficiency in production. For instance, the introduction of advanced vacuum metallization technology has been shown to increase the uniformity of metal layers, thereby improving the overall quality of the films. As manufacturers continue to invest in research and development, the Metalized Barrier Films Market is likely to witness a proliferation of high-performance products that cater to diverse applications, including food packaging and pharmaceuticals.

Increasing Focus on Sustainable Packaging Solutions

Sustainability has emerged as a pivotal concern within the Metalized Barrier Films Market, prompting manufacturers to explore eco-friendly packaging alternatives. The growing awareness of environmental issues has led to a demand for materials that minimize ecological impact. Metalized barrier films, particularly those made from recyclable or biodegradable materials, are gaining traction as viable options. Industry reports suggest that the market for sustainable packaging is expected to grow at a rate of approximately 7% per year, reflecting a shift in consumer preferences towards environmentally responsible products. This trend not only aligns with corporate sustainability goals but also positions the Metalized Barrier Films Market favorably in a competitive landscape increasingly focused on reducing carbon footprints.