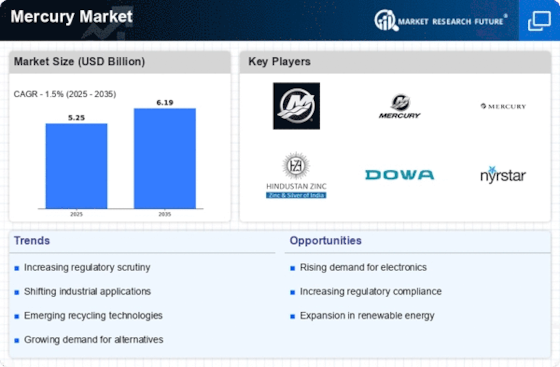

Rising Demand in Electronics

The Mercury Market is experiencing a notable increase in demand driven by the electronics sector. Mercury Market is utilized in various electronic devices, including switches, relays, and batteries. As The Mercury Marketing continues to expand, the need for mercury-based components is likely to rise. In 2025, the electronics industry is projected to reach a valuation of over 1 trillion USD, which could further stimulate the mercury market. This trend suggests that manufacturers are increasingly relying on mercury for its unique properties, such as conductivity and durability, thereby reinforcing its role in the Mercury Market.

Growth in Healthcare Applications

The Mercury Market is witnessing growth due to its applications in healthcare. Mercury Market is used in thermometers, dental amalgams, and certain medical devices. The healthcare sector's expansion, particularly in emerging economies, is likely to drive demand for mercury-based products. In 2025, the healthcare market is expected to surpass 10 trillion USD, indicating a substantial opportunity for mercury suppliers. However, this growth is accompanied by increasing scrutiny regarding mercury's safety, which may influence regulatory frameworks. Thus, while the healthcare sector presents opportunities, it also poses challenges for the Mercury Market.

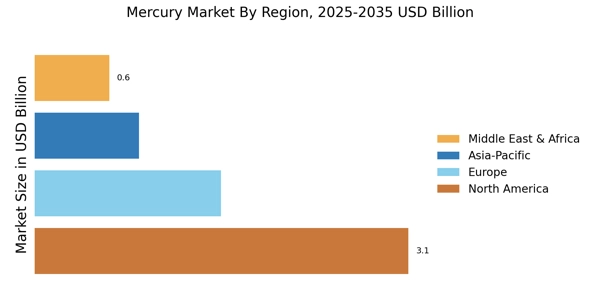

Emerging Markets and Industrialization

The Mercury Market is benefiting from the industrialization of emerging markets. As countries develop, there is a rising demand for mercury in various industrial applications, including mining and manufacturing. The industrial sector in these regions is projected to grow at a compound annual growth rate of 5% through 2025. This growth may lead to increased mercury consumption, particularly in sectors that require its unique properties. However, this trend also raises environmental concerns, as mercury is a hazardous substance. Therefore, the Mercury Market must navigate the balance between industrial growth and environmental sustainability.

Regulatory Developments and Compliance

The Mercury Market is significantly influenced by regulatory developments aimed at controlling mercury usage. Governments and international organizations are implementing stricter regulations to limit mercury emissions and promote safer alternatives. For instance, the Minamata Convention on Mercury Market aims to protect human health and the environment from mercury pollution. These regulations may impact the demand for mercury in certain applications, particularly in developed regions. However, compliance with these regulations could also create opportunities for innovation within the Mercury Market, as companies seek to develop safer, more sustainable alternatives.

Technological Advancements in Extraction

The Mercury Market is poised for transformation due to technological advancements in mercury extraction and recycling. Innovations in extraction techniques are making it more efficient and environmentally friendly to obtain mercury from ores. Additionally, advancements in recycling technologies are enabling the recovery of mercury from waste products, thereby reducing the need for new extraction. As these technologies evolve, they may enhance the sustainability of the Mercury Market. The potential for increased efficiency and reduced environmental impact could attract investment and drive growth in the sector, aligning with global sustainability goals.