Market Analysis

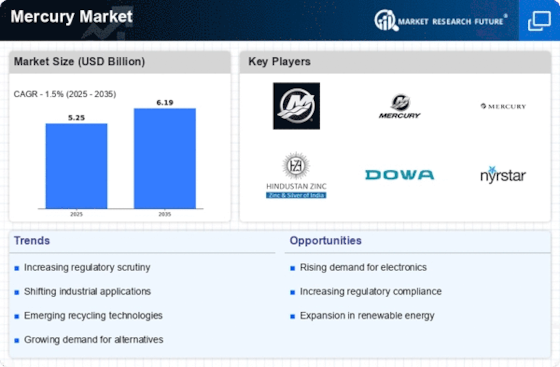

Mercury Market (Global, 2024)

Introduction

The Mercury Market is about to undergo a great transformation, as it tries to cope with the complexities of changing consumer demands, regulatory frameworks, and technological developments. As industries recognize the unique properties and applications of mercury, the market is experiencing an influx of interest from a variety of industries, such as healthcare, electronics, and environment. This study explains the various forces that are reshaping the market, and identifies the key drivers, challenges, and opportunities that need to be considered by market players. This study also highlights the latest trends and strategic insights that will help companies make better business decisions in the coming years.

PESTLE Analysis

- Political

- In 2024 the market for mercury is dominated by international regulations designed to reduce emissions and usage of the element. The Minamata Convention, ratified by 130 countries, bans the export of mercury and the use of the element in a significant way. And so, a total of 50 countries have committed to a reduction of mercury use in artisanal gold mining, which accounts for about 30 percent of the world's demand for the element. This political framework is determining the market for mercury and is causing innovation in alternative materials.

- Economic

- The market for mercury has been subject to the pressures of fluctuating prices and demand. The average price in 2024 is estimated to be around $2,500 a ton, an increase of 15% over the previous year. The main reasons for this rise are the disruption of the supply chain and the costs of complying with the new regulations. The economic performance of the main industries consuming mercury, such as the electrical and medical industries, which together consume over 60% of the total, further increases the price.

- Social

- Public awareness of the health risks of mercury is increasing, and the demand for safer alternatives is growing. In 2024, seventy-five percent of consumers are concerned about the presence of mercury in products, especially in cosmetics and dental amalgam. This social shift is driving manufacturers to find mercury-free alternatives, and by 2024 forty percent of dentists in the United States offer mercury-free dentistry. This growing demand for safer products is changing the behavior of consumers and influencing the trends in the mercury industry.

- Technological

- Advances in technology play a key role in the market for mercury, especially in the development of alternatives and in the methods of recovery. By 2024, investments in research and development for mercury-free technology are expected to reach more than $500 million. There is a growing demand for innovations such as mercury recovery systems and alternative dental materials. More than 30 per cent of dental manufacturers now produce mercury-free products. These technological advances not only help to meet the needs of the environment, but also improve the safety and effectiveness of the products.

- Legal

- The laws regulating the use of mercury are becoming increasingly stringent. In 2024, the European Union will have introduced a new directive requiring all products containing mercury to be clearly labelled, and the penalties for non-compliance will reach up to a million francs. Also, some countries are enacting legislation to give effect to the Minamata Convention. These developments in the law are causing companies to change their practices, ensuring that they are in full compliance while coping with the complexities of international law.

- Environmental

- Environmental concerns about the dangers of mercury are driving both regulatory and market changes. In 2024, it is estimated that some 1,000 tons of mercury will be released into the environment annually, primarily from industrial processes and mining activities. This has resulted in increased scrutiny by governments and the environment sector, and more stringent emission standards. In response, companies are investing in cleaner technology, with over $300 million being invested in mercury-reduction projects in the past year alone. This reflects the growing focus on sustainable development.

Porter's Five Forces

- Threat of New Entrants

- The threat of new entrants into the mercury market in 2024 is moderate. Although the market is highly protected against new entrants by the regulatory framework and the need for specialized knowledge, the increasing demand for mercury in various industries could attract new entrants. The large companies with strong brand names and distribution networks, however, will probably remain the most powerful.

- Bargaining Power of Suppliers

- The monopoly of the mercury market is due to the limited sources of high-quality mercury. The extraction and processing of the metal are expensive and subject to strict sanitary regulations, which limits the number of suppliers. As a result, the suppliers can dictate the terms of supply and the prices on the market, affecting the overall profitability of the companies operating in it.

- Bargaining Power of Buyers

- The buyers in the Mercury Market have a medium degree of power to bargain. The specialized nature of the products makes it difficult for buyers to find alternatives. There are a number of end-users in the different sectors. As awareness of the environment grows, buyers may be more willing to bargain or to switch to substitutes, which could lead to an increase in bargaining power over time.

- Threat of Substitutes

- High - The threat of substitutes in the mercury market is high, especially in view of the health and environment concerns. Non-toxic materials and newer technology are becoming more and more viable. This calls for innovation and adaptation. This change may affect the demand for mercury significantly in the coming years.

- Competitive Rivalry

- Competition in the Mercury Market is intense, and the stakes are high. Several established companies are vying with each other for market share. Product differentiation and aggressive marketing are the mainstays of the companies’ strategies. The need for compliance with regulations and the imperative of sustainable practices has made the Mercury Market a challenging environment for all the players.

SWOT Analysis

Strengths

- High demand for mercury in various industrial applications, including electronics and healthcare.

- Established supply chains and distribution networks for mercury products.

- Strong regulatory frameworks in place ensuring safe handling and usage of mercury.

Weaknesses

- Environmental concerns and regulations limiting mercury extraction and usage.

- Public perception issues related to the toxicity of mercury.

- Limited diversification of products beyond traditional mercury applications.

Opportunities

- Growing demand for mercury in emerging technologies, such as renewable energy and advanced electronics.

- Potential for innovation in mercury recycling and recovery technologies.

- Expansion into new markets where mercury is still in demand, particularly in developing countries.

Threats

- Increasing regulations and potential bans on mercury usage in various sectors.

- Competition from alternative materials that can replace mercury in certain applications.

- Economic fluctuations that could impact the demand for mercury-based products.

Summary

In 2024, the market for mercury is expected to be a mixed one, with strong industrial demand and well-established supply chains, but also facing significant challenges from stricter regulations and public opinion. Opportunities for growth will come from new applications and improvements in the recycling of waste. Regulatory changes and competition from alternatives could disrupt market stability. Strategically, a focus on sustainable production and diversification can help companies to survive in this changing market.

Leave a Comment