Rising Awareness of Mental Health Issues

The increasing recognition of mental health issues globally is a primary driver of the Global Mental Health Software and Devices Market Industry. Governments and organizations are prioritizing mental health, leading to enhanced funding and resources for mental health initiatives. This growing awareness is reflected in the rising demand for software and devices that facilitate mental health care. As of 2024, the market is valued at 6.88 USD Billion, indicating a robust interest in mental health solutions. The emphasis on mental well-being is likely to continue, fostering innovation and expansion within the industry.

Integration of Mental Health into Primary Care

The integration of mental health services into primary care settings is gaining traction, significantly influencing the Global Mental Health Software and Devices Market Industry. This approach facilitates early detection and treatment of mental health conditions, promoting a holistic view of health. As healthcare systems worldwide adopt this model, the demand for software and devices that support integrated care is likely to rise. This trend not only improves patient outcomes but also enhances the efficiency of healthcare delivery. The growing recognition of mental health's role in overall health is expected to drive further investment and innovation in this sector.

Growing Demand for Remote Mental Health Services

The demand for remote mental health services is escalating, particularly in light of the need for accessible care options. This trend is a crucial driver of the Global Mental Health Software and Devices Market Industry. Remote services, including teletherapy and mobile applications, provide individuals with convenient access to mental health support, especially in underserved areas. The market's growth reflects this shift, as more individuals seek flexible and immediate mental health solutions. The increasing reliance on digital platforms for mental health care is expected to continue, further propelling the industry's expansion.

Increased Investment in Mental Health Technologies

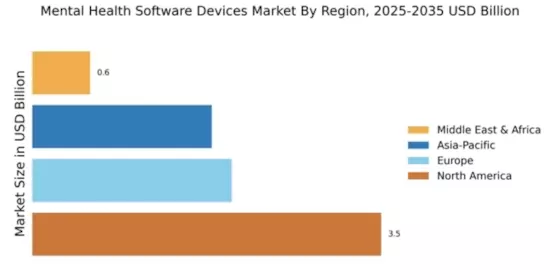

Investment in mental health technologies is surging, driven by both public and private sectors. This trend is a significant catalyst for the Global Mental Health Software and Devices Market Industry. Governments are allocating more resources to mental health initiatives, while private investors recognize the profitability of mental health solutions. The anticipated compound annual growth rate (CAGR) of 16.2% from 2025 to 2035 highlights the growing confidence in the market's potential. This influx of capital is likely to spur innovation and the development of new software and devices, ultimately enhancing mental health care accessibility and quality.

Technological Advancements in Mental Health Solutions

Technological innovations are transforming the landscape of mental health care, significantly impacting the Global Mental Health Software and Devices Market Industry. The integration of artificial intelligence, machine learning, and telehealth capabilities enhances the effectiveness and accessibility of mental health solutions. These advancements enable personalized treatment plans and real-time monitoring of patients' mental health. As a result, the market is projected to grow substantially, with an anticipated value of 35.9 USD Billion by 2035. This growth underscores the potential of technology to improve mental health outcomes and expand the reach of mental health services.