Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the mental health-software-devices market in the UK. The UK government has recognized the importance of mental health and has allocated substantial resources to improve mental health services. Recent budgets have included provisions for digital mental health solutions, which are seen as a cost-effective way to address the growing demand for mental health support. For example, the NHS Long Term Plan emphasizes the need for digital tools to enhance access to mental health services. This commitment to funding and support is likely to stimulate growth in the mental health-software-devices market, as developers and providers are encouraged to innovate and expand their offerings. The collaboration between public health entities and technology companies may lead to the creation of more comprehensive and effective mental health solutions.

Increased Awareness of Mental Health Issues

The growing awareness of mental health issues in the UK has catalyzed a shift in societal attitudes, leading to increased demand for mental health-software-devices market solutions. Campaigns and initiatives aimed at destigmatizing mental health have resulted in more individuals seeking help. According to recent surveys, approximately 1 in 4 adults in the UK experience mental health problems each year, which underscores the necessity for accessible mental health resources. This heightened awareness is driving innovation and investment in the mental health-software-devices market, as companies strive to develop user-friendly applications and devices that cater to diverse needs. Furthermore, the UK government has committed to improving mental health services, which may further bolster the market as funding and resources are allocated to support technological advancements in mental health care.

Technological Advancements in Digital Health

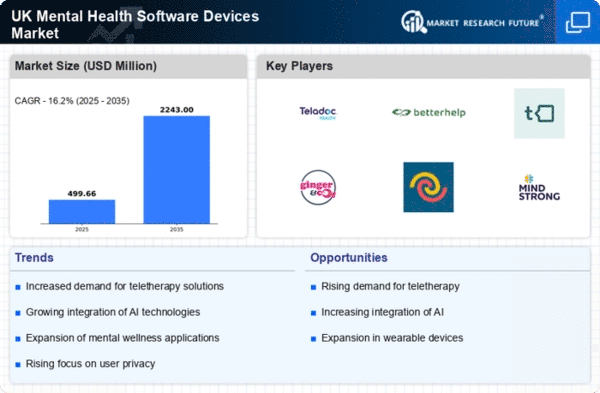

Technological advancements are significantly influencing the mental health-software-devices market in the UK. The proliferation of smartphones and wearable devices has enabled the development of innovative mental health applications that provide real-time support and monitoring. For instance, the use of mobile apps for cognitive behavioral therapy (CBT) has gained traction, with studies indicating that such tools can improve treatment outcomes. The mental health-software-devices market is projected to grow at a CAGR of around 20% over the next five years, driven by these technological innovations. Additionally, the integration of features such as mood tracking and personalized feedback enhances user engagement, making mental health solutions more effective and appealing. As technology continues to evolve, the potential for new applications and devices in the mental health sector appears promising.

Integration of Mental Health in Workplace Policies

The integration of mental health in workplace policies is increasingly influencing the mental health-software-devices market in the UK. Employers are recognizing the importance of mental well-being in enhancing productivity and employee satisfaction. As a result, many organizations are adopting mental health initiatives and providing access to mental health-software-devices market solutions for their employees. This trend is supported by research indicating that mental health support in the workplace can lead to a reduction in absenteeism and an increase in overall performance. Companies are investing in digital tools that facilitate mental health support, such as employee assistance programs and wellness apps. This shift not only benefits employees but also creates a growing market for mental health solutions tailored for workplace environments, indicating a promising avenue for future growth in the mental health-software-devices market.

Rising Demand for Personalized Mental Health Solutions

The rising demand for personalized mental health solutions is a significant driver of the mental health-software-devices market in the UK. Individuals are increasingly seeking tailored approaches to mental health care that address their unique needs and preferences. This trend is reflected in the growing popularity of apps that offer customized therapy plans, mood tracking, and self-help resources. Research indicates that personalized interventions can lead to better engagement and outcomes, which is driving investment in the development of such solutions. The mental health-software-devices market is responding to this demand by incorporating features that allow users to personalize their experience, thereby enhancing the effectiveness of mental health interventions. As consumers become more discerning about their mental health care options, the emphasis on personalization is likely to shape the future landscape of the market.