Emergence of Targeted Therapies

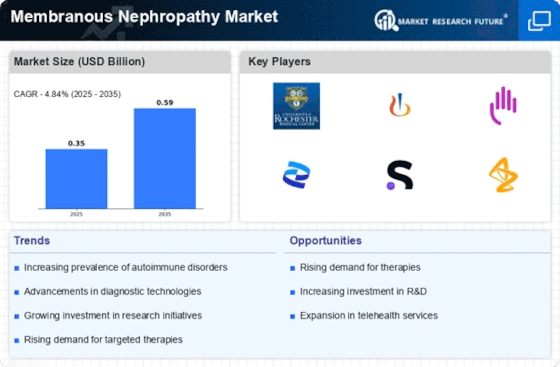

The introduction of targeted therapies represents a transformative shift within the Membranous Nephropathy Market. These therapies, designed to specifically address the underlying mechanisms of the disease, offer the potential for improved efficacy and reduced side effects compared to traditional treatments. Recent clinical trials have shown promising results, indicating that targeted therapies could significantly enhance patient outcomes. The market for these innovative treatments is anticipated to expand, with projections suggesting a growth rate of approximately 8% annually. As more pharmaceutical companies invest in research and development, the Membranous Nephropathy Market is poised for substantial advancements in treatment options.

Rising Investment in Renal Research

The increasing investment in renal research is a significant catalyst for the Membranous Nephropathy Market. Governments and private entities are allocating substantial funds to explore the pathophysiology of kidney diseases, including membranous nephropathy. This influx of funding is likely to accelerate the development of novel therapies and diagnostic tools. Recent reports indicate that research funding for kidney diseases has seen a notable increase, with projections suggesting a growth rate of around 10% over the next few years. As research initiatives expand, the Membranous Nephropathy Market is expected to benefit from a wealth of new knowledge and innovative solutions.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic methodologies are transforming the Membranous Nephropathy Market. Enhanced imaging techniques, such as high-resolution ultrasound and advanced renal biopsy methods, are facilitating earlier and more accurate diagnoses. These advancements not only improve patient outcomes but also drive the demand for specialized diagnostic tools and services. The market for diagnostic devices is projected to grow, with estimates indicating a compound annual growth rate of around 7% over the next few years. As healthcare providers increasingly adopt these technologies, the Membranous Nephropathy Market is likely to experience a surge in investment and development, fostering a more robust healthcare ecosystem.

Growing Awareness and Education Initiatives

Increased awareness and educational initiatives regarding membranous nephropathy are crucial drivers for the Membranous Nephropathy Market. Healthcare professionals and patients are becoming more informed about the disease, its symptoms, and available treatment options. This heightened awareness is likely to lead to earlier diagnosis and treatment, ultimately improving patient outcomes. Organizations dedicated to kidney health are actively promoting educational campaigns, which may contribute to a more informed patient population. As awareness continues to grow, the demand for healthcare services and products related to membranous nephropathy is expected to rise, further stimulating the market.

Increasing Prevalence of Membranous Nephropathy

The rising incidence of membranous nephropathy is a pivotal driver for the Membranous Nephropathy Market. Recent studies indicate that the prevalence of this condition has been steadily increasing, with estimates suggesting that it affects approximately 5 to 10 individuals per 100,000 people annually. This growing patient population necessitates enhanced diagnostic and therapeutic options, thereby propelling market growth. Furthermore, the aging population is likely to contribute to this trend, as older adults are more susceptible to kidney diseases. As healthcare systems adapt to meet the needs of this demographic, the demand for innovative treatments and management strategies within the Membranous Nephropathy Market is expected to rise significantly.