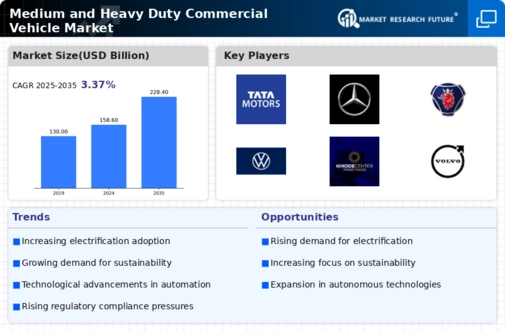

- Q2 2024: Heavy- Medium-Duty Trucks | Model Year 2025 Forecast In the first six months of 2024, production levels for medium- and heavy-duty commercial vehicles continued to improve, with order-to-delivery times following a similar trend in overall growth, though still lagging behind historic 2019 levels.

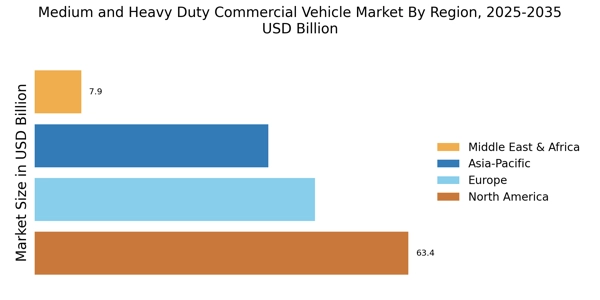

Medium and Heavy Duty Commercial Vehicle Market Regional Insights

The Global Medium and Heavy Duty Commercial Vehicle Market is projected to exhibit significant growth, with regional contributions showcasing diverse valuations. North America holds a majority stake, valued at 50.0 USD Billion in 2023 and expected to rise to 66.0 USD Billion by 2032, driven by the robust logistics and transport sectors. Europe follows closely, with a valuation of 38.0 USD Billion in 2023, increasing to 49.0 USD Billion in 2032, supported by stringent regulations promoting eco-friendly vehicles, making it a significant market.

The APAC region is also noteworthy, projected to grow from 40.0 USD Billion in 2023 to 55.0 USD Billion in 2032, fueled by rapid urbanization and industrialization trends.South America and MEA are smaller segments, with valuations of 10.0 and 10.43 USD Billion in 2023, respectively, showing slower growth but potential for expansion due to increasing demand for transportation solutions. The market growth in these regions reflects the overarching trend towards sustainability and efficiency within the Global Medium and Heavy Duty Commercial Vehicle Market industry.

Each region's performance underscores its unique dynamics, challenges, and opportunities amid evolving market conditions, contributing to the overall Global Medium and Heavy Duty Commercial Vehicle Market statistics and segmentation insights.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Medium and Heavy Duty Commercial Vehicle Market Key Players and Competitive Insights:

The Global Medium and Heavy Duty Commercial Vehicle Market is characterized by a diverse array of manufacturers and fierce competition, driven by the demand for robust logistics and efficient transportation solutions across various industries. As economies expand and urbanization increases, the necessity for larger vehicles designed to transport goods and services continues to rise. Companies in this segment face the challenge of not only keeping pace with technological advancements but also adapting to regulatory changes concerning emissions and safety standards.

The market landscape is marked by leading industry players that continually innovate to provide improved fuel efficiency, enhanced safety features, and advanced connectivity options, all while striving to maintain competitive pricing to attract a broad customer base. Collaboration with technology partners and investment in sustainable practices are becoming pivotal in securing a foothold in this evolving market.Tata Motors has established a formidable presence in the Global Medium and Heavy Duty Commercial Vehicle Market, characterized by its comprehensive range of vehicles that cater specifically to various commercial needs.

Its strengths lie in its robust supply chain and extensive distribution network that facilitate efficient operations across many regions. With a strong emphasis on innovation, Tata Motors has made significant strides in developing vehicles equipped with advanced technologies and eco-friendly solutions, positioning itself as a leader in sustainable transportation. The company's commitment to customer satisfaction through after-sales services and competitive pricing further enhances its appeal to potential clients.

Additionally, Tata Motors' experience in local markets allows it to understand regional requirements effectively, ensuring that its products meet diverse consumer expectations across different geographies.MercedesBenz is recognized for its luxury and performance-focused approach in the Global Medium and Heavy Duty Commercial Vehicle Market, synonymous with quality and innovation. The brand boasts a portfolio that combines performance, safety, and efficiency, setting a high standard for heavy-duty transportation solutions. MercedesBenz's strengths include its commitment to engineering excellence, which is evident in the advanced technology integrated into its vehicles, such as sophisticated driver assistance systems and improved fuel management solutions.

The company's reputation for reliability and durability resonates well within the commercial sector, winning the trust of businesses looking for long-lasting vehicles. Additionally, its focus on sustainability with electric and hybrid vehicle offerings aligns with the growing trend for eco-conscious transport solutions. MercedesBenz's established global footprint ensures that it has a competitive edge in expanding markets, supported by a network of dealerships and support services that enhance customer experience and operational efficiency.

Key Companies in the Medium and Heavy Duty Commercial Vehicle Market Include

Medium and Heavy Duty Commercial Vehicle Market Industry Developments

Recent developments in the Global Medium and Heavy Duty Commercial Vehicle Market showcase a dynamic environment, characterized by significant advancements in technology and sustainability efforts. Companies like Tata Motors and Mercedes-Benz are increasingly exploring electric and hybrid vehicle options to align with global emissions regulations. Scania and Volvo have announced partnerships aimed at developing alternative fuels and enhancing operational efficiency through innovative technologies.

Meanwhile, CNH Industrial and Daimler are focusing on expanding their product lines to include more versatile heavy-duty trucks tailored for specific industries, thereby addressing market demand more effectively.In terms of finances, there has been notable growth in market capitalization among key players such as Paccar and Isuzu, driven by a higher demand for logistics and enhanced supply chain solutions. Reports indicate increasing investments in R&D and technological advancements, further indicating a transition towards electric and autonomous vehicles. Mergers and acquisitions remain pivotal, with companies like Hino and Foton Motor eyeing strategic collaborations to bolster their market positions.

These shifts encapsulate a landscape marked by innovation and strategic growth, highlighting the importance of adapting to consumer preferences and regulatory landscapes in the medium and heavy-duty vehicle sector.