Leading market players are investing heavily in the research and development in order to expand their product lines, which will help the Medium-Duty Truck market grow even more. Market players are also undertaking a variety of strategic activities to spread their global footprint, with important market developments including mergers and acquisitions, new product launches, contractual agreements, higher investments, and collaboration with other organizations. To spread and survive in a more competitive and rising market climate, the Medium-Duty Truck industry must offer cost-effective items.

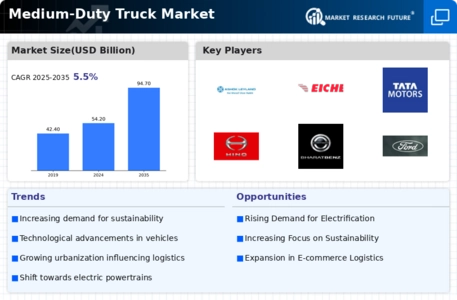

Manufacturing locally to minimize the operational costs is one of the key business tactics used by the manufacturers in the global Medium-Duty Truck industry to benefit the clients and increase the market sector. In recent years, the Medium-Duty Truck industry has offered some of the most significant advantages to automotive industry. Major players in the Medium-Duty Truck market, including Ashok Leyland, Eicher Motors Limited, Tata Motors Limited, Daimler Trucks, Hino Motors, BharatBenz, Ford, Isuzu Motors, Navistar, Freightliner, and others, are trying to increase market demand by investing in the research and development operations.

Navistar International Corporation is a prominent American company specializing in the manufacturing of commercial vehicles, primarily medium and heavy-duty trucks, buses, and military vehicles. The company is recognized for its innovative technologies, including advanced diesel engines and electric vehicle solutions. Navistar has a strong presence in North America and beyond, catering to various sectors such as transportation, construction, defense, and more.

Over the years, the company has been known for its commitment to sustainability and has played a significant role for shaping the landscape of commercial vehicle manufacturing. With a focus on providing the reliable and efficient transportation solutions, Navistar continues to be a major contributor to the evolving automotive industry.

In March Navistar announced that it had formed a partnership with GEICO to offer insurance for autonomous medium-duty trucks. The partnership is expected to help Navistar commercialize its autonomous trucking technology.

PACCAR is a prominent American company that stands as one of the world's largest manufacturers of heavy-duty and medium-duty trucks under the brand names Peterbilt, Kenworth, and DAF. Founded in 1905 and headquartered in Washington, PACCAR has established itself as a leader in the global trucking industry. The company is renowned for its commitment to innovation, producing trucks that integrate advanced technologies for enhanced fuel efficiency, safety, and environmental sustainability. PACCAR's trucks are widely used in various applications, including long-haul trucking, construction, and distribution.

The company's success is attributed not only to its high-quality vehicles but also to its customer-focused approach and dedication to delivering reliable and efficient transportation solutions.

In June PACCAR announced that it had acquired a minority stake in REE Automotive, a startup that develops electric vehicle platforms. The investment is expected to help PACCAR develop electric medium-duty trucks.