Medical Tubing Size

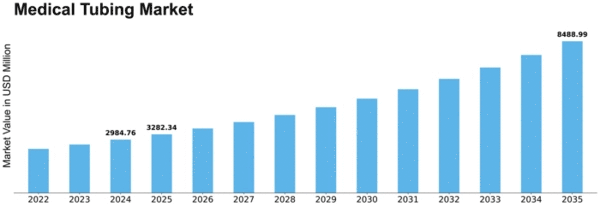

Medical Tubing Market Growth Projections and Opportunities

The medical tubing market is influenced by various factors that drive its growth and development. One of the primary factors is the increasing demand for minimally invasive surgical procedures. These procedures require specialized medical tubing to ensure precise control and delivery of fluids, medications, and devices within the body. As the population ages and the prevalence of chronic diseases rises, the need for such surgeries increases, thereby boosting the demand for medical tubing.

Another significant factor is the advancement in medical technology. Innovations in medical devices and equipment often necessitate new types of tubing with specific properties, such as improved flexibility, durability, and chemical resistance. The development of advanced materials, such as silicone, polyvinyl chloride (PVC), and thermoplastic elastomers (TPE), has expanded the possibilities for medical tubing applications. These materials offer various benefits, including biocompatibility and resistance to a wide range of chemicals, which are crucial for medical applications.

Regulatory standards and compliance also play a crucial role in the medical tubing market. The medical industry is highly regulated, with stringent standards for product safety and efficacy. Compliance with these regulations is essential for market participants, as non-compliance can lead to product recalls, legal issues, and loss of market credibility. Therefore, companies invest heavily in ensuring their products meet the required standards, which can drive up costs but also improve the quality and reliability of the products available in the market.

The growing focus on patient safety and infection control is another factor driving the market. Medical tubing is often used in applications where sterility is paramount, such as intravenous (IV) therapy, catheterization, and drainage systems. The need to minimize the risk of infections and ensure the highest levels of patient safety propels the demand for high-quality, sterile medical tubing. This has led to an increase in the adoption of antimicrobial and anti-thrombogenic coatings on medical tubing, which help in reducing the risk of infections and blood clots.

The expansion of healthcare infrastructure, particularly in developing regions, is also a significant factor. As countries invest in improving their healthcare systems, the demand for medical supplies, including tubing, increases. This is particularly evident in emerging economies where healthcare spending is on the rise, driven by government initiatives and an increasing focus on healthcare accessibility and quality. The expansion of hospitals, clinics, and other healthcare facilities in these regions contributes to the growing demand for medical tubing.

Economic factors, such as the overall economic health and healthcare spending, also impact the medical tubing market. In times of economic growth, there is generally increased investment in healthcare infrastructure and services, which boosts the demand for medical tubing. Conversely, economic downturns can lead to reduced healthcare budgets and spending, potentially slowing market growth.

Additionally, the rising awareness about health and wellness among the general population drives the market. As people become more health-conscious, there is a higher demand for medical services and products, including those that require medical tubing. This trend is supported by increasing disposable incomes and a greater willingness to spend on health-related products and services.

Competitive dynamics within the market also play a role. The presence of numerous manufacturers and suppliers leads to continuous innovation and improvement in product offerings. Companies strive to gain a competitive edge through product differentiation, cost-effectiveness, and superior quality. This competition fosters advancements in the market, benefitting end-users with better and more varied options.

Leave a Comment