Increasing Healthcare Expenditure

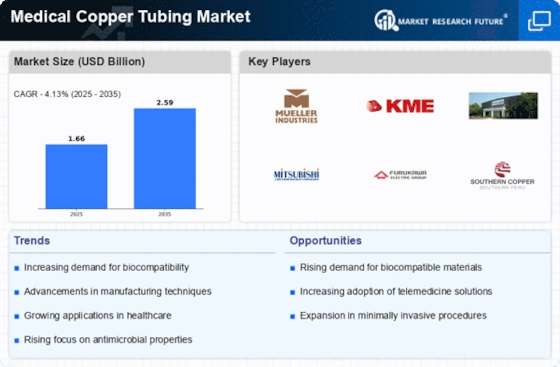

The Medical Copper Tubing Market is experiencing growth due to rising healthcare expenditure across various regions. Governments and private sectors are investing significantly in healthcare infrastructure, which includes the procurement of advanced medical equipment. This trend is likely to enhance the demand for medical copper tubing, as it is a critical component in various medical devices. According to recent data, healthcare spending is projected to increase by approximately 5% annually, which could lead to a substantial rise in the consumption of medical copper tubing. As healthcare facilities expand and modernize, the need for reliable and efficient materials like copper tubing becomes paramount, thereby driving the market forward.

Growing Demand for Sustainable Materials

The growing demand for sustainable materials is influencing the Medical Copper Tubing Market. As healthcare organizations strive to adopt environmentally friendly practices, the use of recyclable and sustainable materials like copper is gaining traction. Copper is not only durable but also 100% recyclable, making it an attractive option for manufacturers looking to reduce their environmental footprint. Market trends suggest that the emphasis on sustainability in healthcare is likely to drive the demand for medical copper tubing, as organizations seek to align their procurement strategies with eco-friendly initiatives. This shift towards sustainability could potentially reshape the landscape of the medical tubing market.

Rising Awareness of Antimicrobial Properties

The rising awareness of the antimicrobial properties of copper is significantly influencing the Medical Copper Tubing Market. As healthcare providers increasingly recognize the benefits of using antimicrobial materials, the demand for copper tubing is expected to rise. Studies have shown that copper surfaces can reduce the presence of harmful bacteria, making them ideal for medical applications. This awareness is likely to drive the adoption of copper tubing in hospitals and clinics, where infection control is a priority. The market for antimicrobial materials is projected to grow, potentially leading to a corresponding increase in the use of medical copper tubing in various healthcare settings.

Technological Advancements in Medical Devices

Technological advancements in medical devices are a pivotal driver for the Medical Copper Tubing Market. Innovations in medical technology, such as minimally invasive surgical instruments and advanced diagnostic equipment, necessitate the use of high-quality materials like copper tubing. The integration of copper tubing in these devices enhances their performance and reliability. Market data indicates that the medical device sector is expected to grow at a compound annual growth rate of around 6% over the next few years. This growth is likely to spur demand for medical copper tubing, as manufacturers seek to incorporate superior materials that offer durability and antimicrobial properties.

Regulatory Support for Copper in Medical Applications

Regulatory support for the use of copper in medical applications is emerging as a key driver for the Medical Copper Tubing Market. Various health authorities are recognizing the benefits of copper and are establishing guidelines that promote its use in medical devices. This regulatory backing is likely to encourage manufacturers to incorporate copper tubing into their products, thereby expanding the market. Additionally, as regulations evolve to favor materials that enhance patient safety and reduce infection rates, the demand for medical copper tubing may see a significant uptick. This trend indicates a favorable environment for the growth of the market.