Expansion of Health Insurance Coverage

The expansion of health insurance coverage is a pivotal driver in the Medical Devices Reimbursement Market. As more individuals gain access to health insurance, the demand for reimbursable medical devices is likely to increase. Recent statistics indicate that insurance coverage has expanded significantly, with millions more individuals now eligible for various medical services. This expansion facilitates greater access to necessary medical devices, which in turn drives market growth. Insurers are increasingly recognizing the value of reimbursing innovative medical devices that improve patient outcomes, thus creating a more favorable environment for manufacturers and healthcare providers alike. The interplay between insurance coverage and device reimbursement is crucial for the sustainability of the Medical Devices Reimbursement Market.

Growing Emphasis on Patient-Centric Care

The growing emphasis on patient-centric care is transforming the Medical Devices Reimbursement Market. Healthcare systems are increasingly prioritizing patient outcomes and satisfaction, which influences reimbursement policies. This shift encourages the adoption of medical devices that align with patient needs and preferences. Data suggests that patient engagement in treatment decisions leads to better health outcomes, prompting insurers to support devices that facilitate this engagement. As healthcare providers focus on delivering personalized care, the demand for reimbursable medical devices that enhance patient experience is likely to rise. This trend not only benefits patients but also drives innovation and investment within the Medical Devices Reimbursement Market.

Technological Advancements in Medical Devices

Technological advancements are reshaping the Medical Devices Reimbursement Market in profound ways. Innovations such as minimally invasive surgical techniques, telemedicine, and wearable health monitoring devices are gaining traction. These advancements not only enhance patient care but also influence reimbursement policies. For instance, the integration of artificial intelligence in diagnostic devices has shown to improve accuracy and efficiency, prompting insurers to reconsider reimbursement strategies. The market for such technologically advanced devices is expected to reach a valuation of over $500 billion by 2026, reflecting the growing recognition of their value in clinical settings. As technology continues to evolve, the Medical Devices Reimbursement Market must adapt to ensure that reimbursement frameworks align with these innovations.

Rising Demand for Advanced Medical Technologies

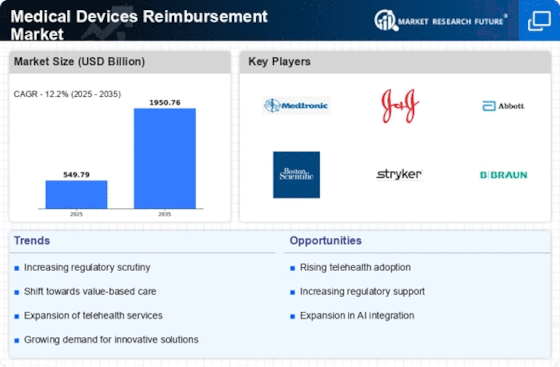

The Medical Devices Reimbursement Market is experiencing a notable surge in demand for advanced medical technologies. This trend is driven by an increasing prevalence of chronic diseases and an aging population, which necessitate innovative medical solutions. According to recent data, the market for advanced medical devices is projected to grow at a compound annual growth rate (CAGR) of approximately 7.5% over the next five years. As healthcare providers seek to improve patient outcomes, the reimbursement landscape is adapting to accommodate these advanced technologies. This shift not only enhances patient care but also encourages manufacturers to invest in research and development, thereby fostering a cycle of innovation within the Medical Devices Reimbursement Market.

Increased Regulatory Support for Innovative Devices

Increased regulatory support for innovative medical devices is a significant driver in the Medical Devices Reimbursement Market. Regulatory bodies are streamlining approval processes for new devices, thereby facilitating quicker market entry. This support is crucial for manufacturers looking to introduce cutting-edge technologies that can improve patient care. Recent initiatives have focused on expediting the review of devices that demonstrate substantial clinical benefits. As a result, the market is witnessing a rise in the number of innovative devices eligible for reimbursement. This regulatory environment not only encourages investment in research and development but also enhances competition within the Medical Devices Reimbursement Market, ultimately benefiting patients and healthcare providers.