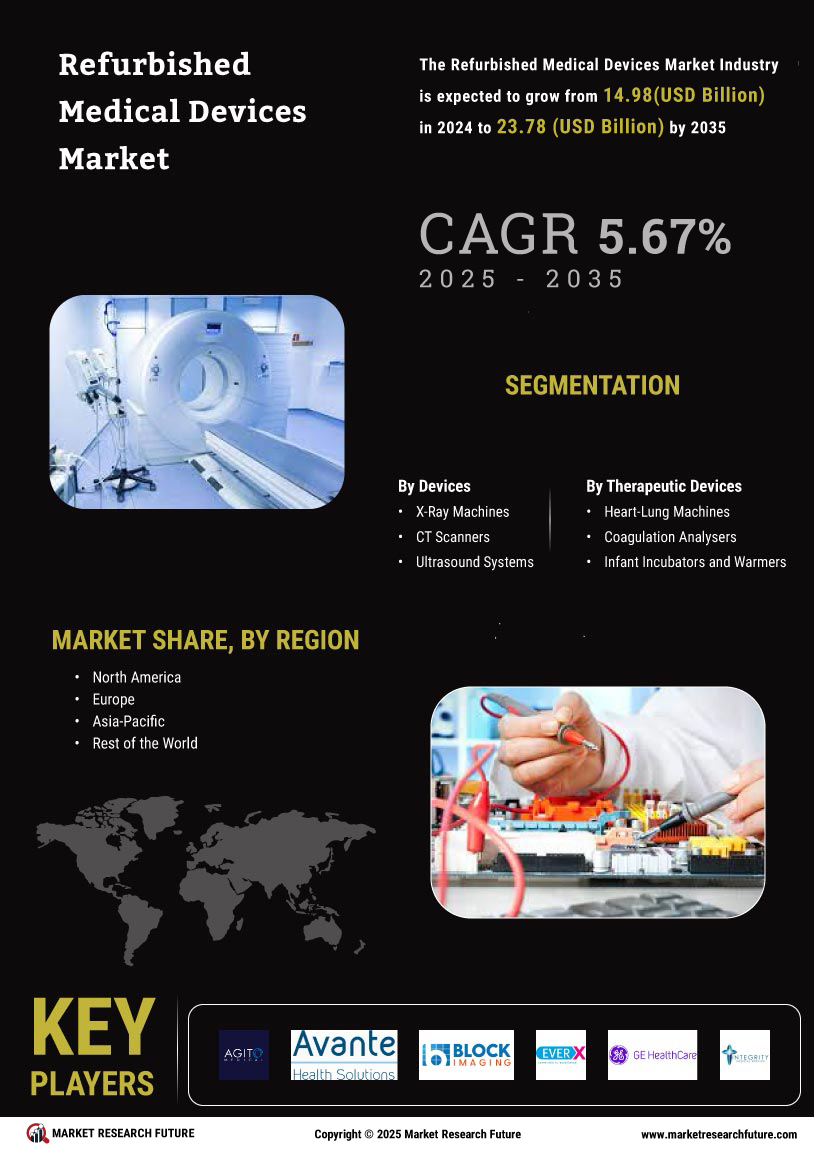

Cost Efficiency in Healthcare

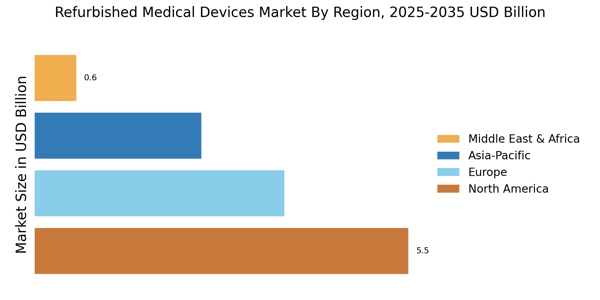

The rising cost of healthcare has prompted many institutions to seek cost-effective solutions, leading to an increased interest in the Refurbished Medical Devices Market. Refurbished devices often provide a more affordable alternative to new equipment, allowing healthcare providers to allocate resources more efficiently. For instance, hospitals can save up to 50% on equipment costs by opting for refurbished devices. This trend is particularly evident in developing regions where budget constraints are more pronounced. As healthcare systems strive to maintain quality while managing expenses, the demand for refurbished medical devices is likely to grow, indicating a shift in purchasing strategies across the industry.

Regulatory Support and Standards

Regulatory bodies have increasingly recognized the importance of refurbished medical devices, leading to the establishment of stringent standards and guidelines. This regulatory support enhances the credibility of the Refurbished Medical Devices Market, as it assures healthcare providers of the safety and efficacy of refurbished products. Compliance with these regulations not only fosters trust among consumers but also encourages manufacturers to invest in refurbishment processes. As a result, the market is witnessing a surge in refurbished devices that meet high-quality standards, which could potentially expand market share and consumer acceptance in the coming years.

Environmental Sustainability Concerns

The emphasis on environmental sustainability has become a pivotal driver for the Refurbished Medical Devices Market. As healthcare organizations strive to reduce their carbon footprint, refurbished devices present an eco-friendly alternative to new equipment. By extending the lifecycle of medical devices, refurbishment practices contribute to waste reduction and resource conservation. This alignment with sustainability goals not only appeals to environmentally conscious consumers but also positions refurbished devices as a responsible choice in the healthcare sector. The market is likely to benefit from this trend as more institutions adopt sustainable practices in their procurement strategies.

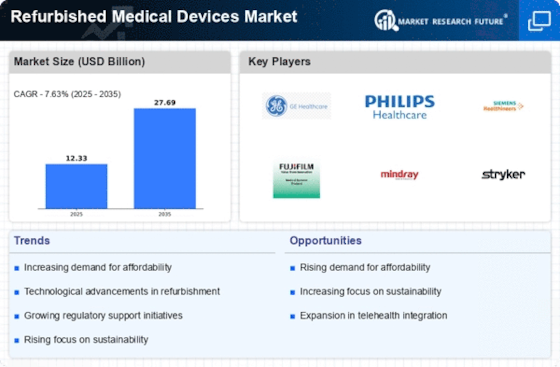

Increased Demand for Medical Equipment

The growing demand for medical equipment, driven by an aging population and rising chronic diseases, has created a favorable environment for the Refurbished Medical Devices Market. As healthcare facilities expand to meet patient needs, the pressure to acquire more equipment intensifies. Refurbished devices offer a viable solution to this demand, providing access to essential medical technology without the prohibitive costs associated with new devices. Market data suggests that the refurbishment sector could see a compound annual growth rate of approximately 10% over the next few years, reflecting the increasing reliance on refurbished solutions to address healthcare challenges.

Technological Innovations in Refurbishment

Technological advancements in refurbishment processes are enhancing the quality and reliability of refurbished medical devices, thereby bolstering the Refurbished Medical Devices Market. Innovations such as advanced diagnostic tools and automated refurbishment techniques are improving the efficiency of the refurbishment process. These developments ensure that refurbished devices meet or exceed the performance of new equipment, which is crucial for gaining the trust of healthcare providers. As technology continues to evolve, the market is expected to witness an influx of high-quality refurbished devices, potentially reshaping purchasing decisions and expanding market opportunities.