Technological Innovations

Technological advancements are significantly shaping the Medical Device Testing Services Market. Innovations in testing methodologies, such as the integration of artificial intelligence and machine learning, are enhancing the accuracy and efficiency of testing processes. These technologies enable faster data analysis and improved predictive modeling, which are crucial for assessing device performance and safety. The market is expected to grow as manufacturers increasingly adopt these advanced testing solutions to meet the demands of a rapidly evolving healthcare landscape. In 2025, the adoption of such technologies could potentially increase the market size by 15%, reflecting the industry's shift towards more sophisticated testing capabilities.

Regulatory Compliance Pressure

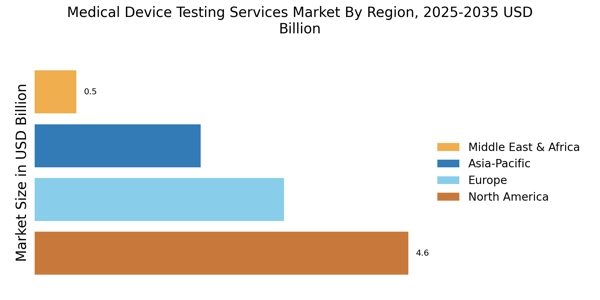

The Medical Device Testing Services Market is experiencing heightened pressure from regulatory bodies to ensure compliance with stringent safety and efficacy standards. As regulations evolve, manufacturers are compelled to engage testing services that can validate their products against these requirements. This trend is underscored by the increasing complexity of regulatory frameworks, which necessitates comprehensive testing protocols. In 2025, the market for medical device testing services is projected to reach approximately 5 billion USD, driven by the need for compliance with international standards such as ISO 13485 and FDA regulations. Companies that invest in robust testing services are likely to gain a competitive edge, as they can more efficiently navigate the regulatory landscape and bring their products to market faster.

Growing Focus on Patient Safety

The Medical Device Testing Services Market is increasingly influenced by a growing focus on patient safety. As healthcare providers and patients alike demand higher standards of safety and efficacy, manufacturers are compelled to prioritize rigorous testing protocols. This trend is reflected in the rising number of adverse event reports and recalls, which highlight the critical need for thorough testing. In 2025, the market is projected to expand as manufacturers recognize that investing in comprehensive testing services not only mitigates risks but also enhances their reputation and trust among consumers. The emphasis on patient safety is likely to drive the demand for testing services that ensure devices are safe and effective for end-users.

Increased Investment in Healthcare R&D

Investment in healthcare research and development is a critical driver for the Medical Device Testing Services Market. As companies allocate more resources to innovate and develop new medical devices, the demand for comprehensive testing services rises correspondingly. In 2025, it is anticipated that R&D spending in the healthcare sector will exceed 200 billion USD, with a significant portion directed towards testing and validation services. This influx of investment is likely to enhance the capabilities of testing service providers, enabling them to offer more advanced and reliable testing solutions. Consequently, the market for medical device testing services is expected to grow as manufacturers seek to ensure their products meet the highest standards of quality and safety.

Rising Demand for Personalized Medicine

The Medical Device Testing Services Market is witnessing a surge in demand for personalized medicine, which necessitates tailored testing services. As healthcare shifts towards individualized treatment plans, medical devices must be rigorously tested to ensure they meet the specific needs of diverse patient populations. This trend is likely to drive the growth of testing services that focus on biocompatibility, efficacy, and safety for various demographics. The market is projected to expand as manufacturers seek to validate their devices for personalized applications, potentially increasing the market size by 10% by 2025. This shift underscores the importance of specialized testing services in meeting the unique requirements of personalized healthcare.