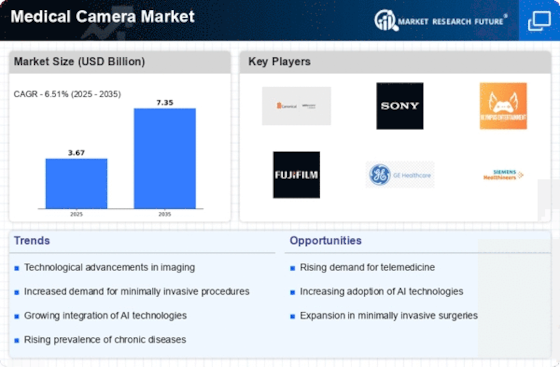

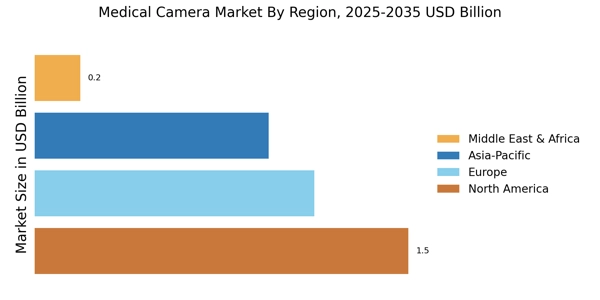

North America : Healthcare Innovation Leader

North America is the largest market for medical cameras, holding approximately 40% of the global share, driven by advanced healthcare infrastructure, high adoption rates of innovative technologies, and significant investments in R&D. The U.S. leads this region, supported by favorable reimbursement policies and a growing elderly population, which increases the demand for diagnostic imaging. Canada follows as the second-largest market, contributing around 10% to the overall share, with a focus on enhancing healthcare services. The competitive landscape in North America is robust, featuring key players like GE Healthcare, Siemens Healthineers, and Stryker. These companies are at the forefront of technological advancements, offering a range of medical cameras for various applications, including surgical and diagnostic purposes. The presence of established healthcare facilities and a strong emphasis on patient care further bolster market growth, making it a focal point for innovation in medical imaging.

Europe : Regulatory Framework Enhancer

Europe is a significant player in the medical camera market, accounting for approximately 30% of the global share. The region benefits from stringent regulatory frameworks that ensure high-quality standards in medical devices, driving demand for advanced imaging solutions. Germany and the UK are the largest markets, together holding about 15% of the total share, with increasing investments in healthcare technology and a focus on improving patient outcomes. Leading countries in Europe, such as Germany, France, and the UK, host major players like Siemens Healthineers and Philips. The competitive landscape is characterized by a mix of established companies and innovative startups, fostering a dynamic environment for growth. The European market is also influenced by initiatives aimed at enhancing healthcare delivery, which further propels the demand for medical cameras, ensuring compliance with regulatory standards. "The European Union has established comprehensive regulations to ensure the safety and efficacy of medical devices, including imaging technologies."

Asia-Pacific : Emerging Market Potential

Asia-Pacific is an emerging powerhouse in the medical camera market, holding around 25% of the global share. The region is experiencing rapid growth due to increasing healthcare expenditures, a rising population, and advancements in medical technology. China and Japan are the largest markets, contributing approximately 15% and 5% respectively, driven by government initiatives to improve healthcare infrastructure and access to advanced medical imaging solutions. The competitive landscape in Asia-Pacific is evolving, with key players like Canon, Sony, and Olympus leading the market. The presence of these companies is bolstered by local partnerships and collaborations aimed at enhancing product offerings. Additionally, the growing demand for minimally invasive surgeries and diagnostic procedures is further fueling the adoption of medical cameras, making this region a focal point for future growth in the medical imaging sector.

Middle East and Africa : Resource-Rich Market Dynamics

The Middle East and Africa (MEA) region is witnessing a gradual increase in the medical camera market, holding approximately 5% of the global share. The growth is primarily driven by rising healthcare investments, increasing awareness of advanced medical technologies, and a growing population. Countries like South Africa and the UAE are leading the market, contributing around 3% and 1% respectively, as they enhance their healthcare systems and infrastructure to meet rising demands. The competitive landscape in MEA is characterized by a mix of local and international players, with companies like GE Healthcare and Philips establishing a strong presence. The region's focus on improving healthcare access and quality is fostering partnerships and collaborations, which are essential for market growth. The increasing prevalence of chronic diseases is also driving the demand for advanced medical imaging solutions, making MEA a region of interest for future investments.