Emergence of Smart Shipping Solutions

The emergence of smart shipping solutions is a key driver for the Maritime VSAT Market. As the maritime sector embraces digital transformation, there is a growing trend towards the adoption of smart technologies that enhance operational efficiency and reduce costs. Smart shipping solutions leverage data analytics, IoT, and automation to optimize vessel performance and improve decision-making processes. The integration of VSAT systems is essential for these technologies, as they provide the necessary connectivity for real-time data transmission and remote monitoring. Market forecasts suggest that the smart shipping segment is likely to experience substantial growth, with many shipping companies investing in digital solutions to remain competitive. This shift towards smart shipping not only enhances operational capabilities but also aligns with sustainability goals, further solidifying the role of the Maritime VSAT Market in the future of maritime operations.

Increased Focus on Safety and Security

The Maritime VSAT Market is witnessing an increased focus on safety and security, which is driving the demand for advanced communication solutions. With the rise in maritime threats, including piracy and cyberattacks, there is a pressing need for reliable communication systems that can ensure the safety of vessels and crew. Regulatory bodies are imposing stricter safety standards, necessitating the implementation of robust communication technologies. VSAT systems play a crucial role in enhancing situational awareness and enabling rapid response to emergencies. Market analysis indicates that investments in maritime security technologies are expected to grow, with a significant portion allocated to satellite communication systems. This trend highlights the critical importance of the Maritime VSAT Market in safeguarding maritime operations and ensuring compliance with international safety regulations.

Expansion of Maritime Trade and Logistics

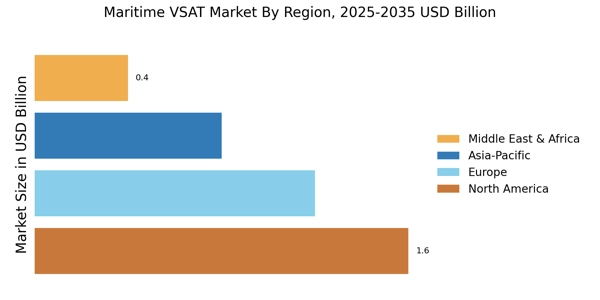

The Maritime VSAT Market is poised for growth due to the expansion of maritime trade and logistics. As global trade continues to flourish, the shipping industry is increasingly reliant on advanced communication systems to manage logistics and supply chains effectively. The rise in container shipping and the need for efficient fleet management have led to a heightened demand for VSAT solutions that can provide seamless connectivity across vast oceanic distances. Market data suggests that the shipping industry is expected to see a compound annual growth rate (CAGR) of over 4% in the coming years, which will likely drive investments in satellite communication technologies. This expansion not only enhances operational efficiency but also improves the ability to monitor cargo conditions and ensure compliance with international shipping regulations, thereby reinforcing the critical role of the Maritime VSAT Market.

Growing Demand for Enhanced Communication Solutions

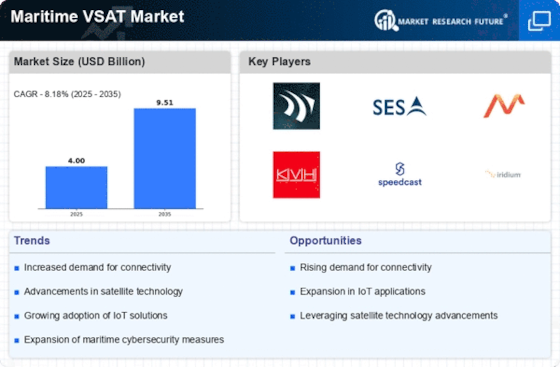

The Maritime VSAT Market is experiencing a notable surge in demand for enhanced communication solutions. As maritime operations become increasingly complex, the need for reliable and high-speed connectivity is paramount. This demand is driven by the necessity for real-time data exchange, which is critical for navigation, safety, and operational efficiency. According to recent estimates, the maritime sector is projected to invest significantly in satellite communication technologies, with a focus on VSAT systems that offer robust bandwidth and low latency. This trend indicates a shift towards more integrated communication platforms that can support various applications, including crew welfare, operational management, and compliance with international regulations. The growing reliance on digital technologies in maritime operations further underscores the importance of advanced communication solutions, positioning the Maritime VSAT Market for substantial growth.

Technological Advancements in Satellite Communication

Technological advancements in satellite communication are significantly influencing the Maritime VSAT Market. Innovations such as high-throughput satellites (HTS) and low Earth orbit (LEO) satellite constellations are revolutionizing the capabilities of maritime communication systems. These advancements enable higher data rates and improved coverage, which are essential for modern maritime operations. The introduction of HTS has been particularly impactful, as it allows for more efficient bandwidth utilization, thereby reducing costs for maritime operators. Furthermore, the integration of artificial intelligence and machine learning in satellite communication systems is enhancing data analytics and operational decision-making. As these technologies continue to evolve, they are expected to drive further adoption of VSAT solutions in the maritime sector, indicating a robust growth trajectory for the Maritime VSAT Market.