Top Industry Leaders in the Maritime VSAT Market

Strategies Adopted: Key players in the Maritime VSAT Market deploy various strategies to maintain their competitive edge and capitalize on market opportunities. These strategies include:

Network Expansion: Companies invest in expanding their satellite networks, coverage areas, and capacity to provide reliable, high-speed connectivity to maritime vessels operating in remote and challenging environments worldwide.

Service Differentiation: Companies differentiate their service offerings through value-added features, such as bandwidth management, cybersecurity, content delivery, and customer support, tailored to the unique needs and requirements of maritime customers.

Industry Partnerships: Collaborations with maritime equipment manufacturers, shipbuilders, navigation providers, and industry associations help companies address market needs, develop integrated solutions, and access new customer segments and distribution channels.

Vertical Integration: Vertical integration across the value chain, including satellite infrastructure, terminal hardware, software platforms, and managed services, allows companies to offer end-to-end solutions that streamline deployment, operation, and maintenance for maritime customers.

Competitive Landscape

KVH Industries, Inc. (US),

OmniAccess SL (Spain),

SageNet Inc. (US),

Raytheon Company (US),

Comtech Telecommunications Corp. (US),

EchoStar Corporation (US),

EMC (US),

Inmarsat Group Limited (UK),

Speedcast International Limited (Australia)

TelespazioSpA (Italy),

Viasat Inc. (US),

VT iDirect, Inc. (US)

Factors for Market Share Analysis: Several factors contribute to the analysis of market share in the Maritime VSAT Market, including:

Network Performance: The performance, reliability, and coverage of satellite networks play a critical role in determining market share, with companies offering robust, low-latency connectivity and seamless handover between satellite beams and constellations gaining a competitive advantage.

Pricing and Value Proposition: Competitive pricing, flexible service plans, and value-added features, such as data compression, traffic prioritization, and bundled services, influence market share by addressing cost concerns and delivering tangible benefits to maritime customers.

Customer Relationships: Strong relationships with shipping companies, fleet operators, vessel owners, and maritime regulators enhance market share by fostering trust, loyalty, and long-term partnerships, with companies offering responsive customer support and tailored solutions gaining a competitive edge.

Regulatory Compliance: Compliance with maritime regulations, international standards, and industry best practices, such as IMO (International Maritime Organization) regulations for satellite communication and cybersecurity guidelines, is essential for gaining market share and securing contracts in the maritime industry.

New and Emerging Companies: In addition to established players, new and emerging companies are entering the Maritime VSAT Market, bringing innovative technologies and solutions. These companies often focus on niche segments or disruptive approaches, challenging traditional players and driving innovation in the industry. Some notable new and emerging companies in the market include:

OneWeb

SpaceX

O3b Networks (SES Networks)

Telesat

LeoSat Enterprises

Phasor Solutions Limited

OmniAccess

OmniSpace Technologies

RigNet, Inc.

Satcom Global Ltd.

Industry News and Current Investment Trends: Recent developments and investment trends in the Maritime VSAT Market reflect a growing interest in high-throughput satellites, hybrid networks, and digitalization initiatives. Key highlights include:

High-Throughput Satellites: Companies are launching high-throughput satellite (HTS) constellations with increased capacity, bandwidth, and efficiency to meet growing demand for broadband connectivity, video streaming, and data-intensive applications on maritime vessels.

Hybrid Network Solutions: Integration of satellite, terrestrial, and wireless technologies enables companies to offer hybrid network solutions that provide seamless connectivity, redundancy, and coverage extension for maritime customers operating in remote or congested areas.

Digitalization and IoT Integration: Adoption of digitalization and Internet of Things (IoT) technologies enables maritime customers to optimize operations, improve efficiency, and enhance safety and security through real-time monitoring, predictive analytics, and remote management capabilities.

Investment in Cybersecurity: Companies are investing in cybersecurity solutions, encryption technologies, and threat intelligence to address cybersecurity risks and vulnerabilities associated with maritime VSAT networks, ensuring the integrity, confidentiality, and availability of data and communications.

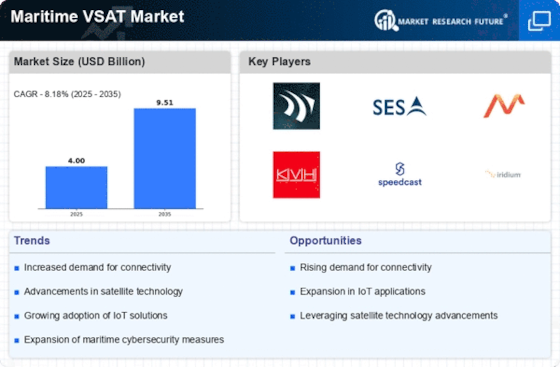

Overall Competitive Scenario: The Maritime VSAT Market is highly competitive, driven by technological innovation, network performance, and customer relationships. Established players leverage their experience, infrastructure, and industry partnerships to maintain market leadership, while new entrants disrupt the market with novel technologies and business models. As the demand for maritime connectivity continues to grow, companies that focus on network reliability, service differentiation, and regulatory compliance will thrive in the competitive landscape of the Maritime VSAT Market.

Recent developments

In May 2019, Hughes communications industry, a part of EchoStar corporation, got into partnership with Bharti Airtel to combine the VSAT operations in India. They aim to offer high-quality, reliable, and secure solutions across the country.

In January 2019, Speedcast international limited signed a contract with Fred, Olsen Windcarrier. This contract offers a unique communication onboard solution that combines 4G LTE for better delivery of data and voice Services for crew welfare networks, operators, and corporate.

In June 2017, Inmarsat Group Limited quadrupled its number of teleports to meet the requirement of Fleet Xpress services.