Expansion of Cloud-Based Services

The Enterprise VSAT Market is significantly influenced by the expansion of cloud-based services. As organizations increasingly migrate their operations to the cloud, the requirement for robust and reliable internet connectivity intensifies. This shift necessitates the deployment of VSAT solutions that can support high data transfer rates and low latency. Market data indicates that the cloud services market is expected to reach a valuation of over 800 billion dollars by 2025, further propelling the demand for satellite communication solutions. Enterprises are seeking VSAT services that can seamlessly integrate with their cloud applications, ensuring efficient data management and accessibility. This trend underscores the critical role of the Enterprise VSAT Market in facilitating the digital transformation of businesses.

Rising Demand for High-Speed Internet

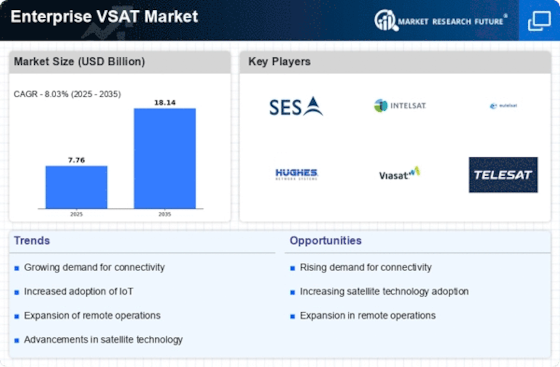

The Enterprise VSAT Market is experiencing a notable surge in demand for high-speed internet connectivity. As businesses increasingly rely on digital platforms for operations, the need for reliable and fast internet access becomes paramount. This trend is particularly evident in remote and underserved regions where traditional broadband infrastructure is lacking. According to recent data, the demand for satellite internet services is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the necessity for uninterrupted connectivity, enabling enterprises to maintain productivity and enhance customer engagement. Consequently, service providers in the Enterprise VSAT Market are investing in advanced satellite technologies to meet this escalating demand.

Growth in Remote Work and Telecommuting

The Enterprise VSAT Market is witnessing growth driven by the increasing prevalence of remote work and telecommuting arrangements. As organizations adapt to flexible work models, the need for reliable communication tools becomes essential. VSAT technology offers a viable solution for remote employees, providing them with consistent internet access regardless of their location. Recent statistics suggest that nearly 30% of the workforce is now engaged in remote work, a trend that is likely to persist. This shift not only enhances employee satisfaction but also necessitates the deployment of advanced satellite communication systems to ensure seamless connectivity. The Enterprise VSAT Market is thus positioned to capitalize on this trend, offering tailored solutions that cater to the unique needs of remote workers.

Emergence of New Applications and Use Cases

The Enterprise VSAT Market is evolving with the emergence of new applications and use cases. Industries such as agriculture, maritime, and emergency services are increasingly adopting VSAT technology to enhance operational efficiency and communication capabilities. For instance, in agriculture, satellite communication is being utilized for precision farming, enabling farmers to monitor crop health and optimize resource usage. Market analysis suggests that the adoption of VSAT solutions in these sectors could lead to a growth rate of approximately 15% over the next few years. This diversification of applications not only broadens the market scope but also highlights the versatility of the Enterprise VSAT Market in addressing various industry-specific challenges.

Increased Investment in Satellite Infrastructure

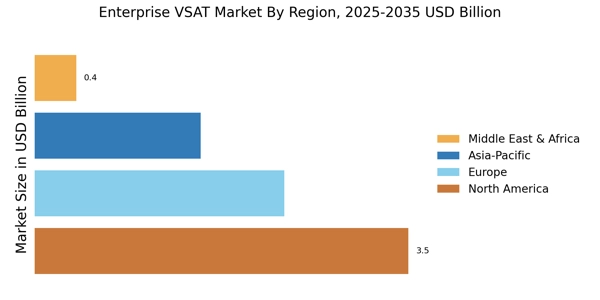

The Enterprise VSAT Market is benefiting from increased investment in satellite infrastructure. Governments and private entities are recognizing the strategic importance of satellite communication in enhancing connectivity, particularly in rural and remote areas. Recent initiatives indicate that investments in satellite technology are expected to exceed 20 billion dollars by 2026, aimed at expanding coverage and improving service quality. This influx of capital is likely to lead to advancements in satellite technology, including the deployment of high-throughput satellites that can deliver faster and more reliable services. As a result, the Enterprise VSAT Market is poised for growth, as enhanced infrastructure will enable service providers to offer competitive solutions that meet the evolving demands of businesses.