Managed DNS Services Market Summary

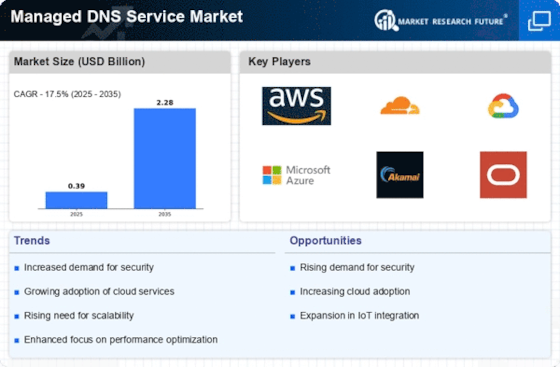

As per Market Research Future analysis, the Managed DNS Service Market Size was estimated at 0.3866 USD Billion in 2024. The Managed DNS Service industry is projected to grow from USD 0.4542 Billion in 2025 to USD 2.279 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 17.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Managed DNS Service Market is experiencing robust growth driven by technological advancements and increasing demand for reliable internet services.

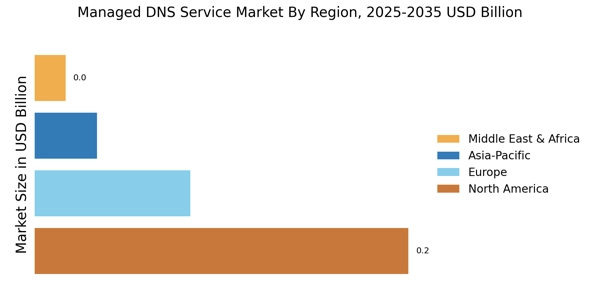

- Cloud-based solutions are becoming increasingly prevalent, particularly in North America, as organizations seek scalable and flexible DNS management.

- Enhanced security features are gaining traction, especially among large enterprises, to combat rising cybersecurity threats.

- Automation and AI integration are emerging trends, facilitating more efficient DNS operations and management.

- The growth of e-commerce and online services, coupled with regulatory compliance and data privacy concerns, is driving demand for DDoS protected DNS solutions in the Asia-Pacific region.

Market Size & Forecast

| 2024 Market Size | 0.3866 (USD Billion) |

| 2035 Market Size | 2.279 (USD Billion) |

| CAGR (2025 - 2035) | 17.5% |

Major Players

Amazon Web Services (US), Cloudflare (US), Google Cloud (US), Microsoft Azure (US), Akamai Technologies (US), Oracle (US), NS1 (US), Dyn (US), UltraDNS (US)