Growth of IoT Devices

The proliferation of Internet of Things (IoT) devices in Brazil is emerging as a crucial driver for the managed dns-services market. With an estimated 50 million IoT devices expected to be operational by 2025, the demand for reliable DNS services to manage these devices is likely to escalate. IoT applications require consistent connectivity and low latency, which can be effectively supported by managed DNS solutions. As organizations deploy more IoT devices, the complexity of DNS management increases, necessitating specialized services that can handle the unique challenges posed by these devices. This trend indicates a growing recognition of the importance of managed DNS services in ensuring the seamless operation of IoT ecosystems, thereby propelling market growth.

Increased Focus on Cybersecurity

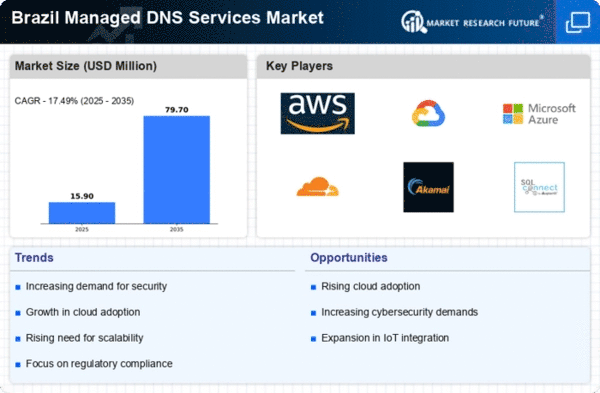

In Brazil, the increasing focus on cybersecurity is significantly impacting the managed dns-services market. As cyber threats become more sophisticated, organizations are prioritizing the implementation of robust security measures, including advanced DNS protection. The managed dns-services market is likely to benefit from this heightened awareness, as businesses seek solutions that offer enhanced security features such as DDoS protection and threat intelligence. In 2025, it is anticipated that cybersecurity spending in Brazil will increase by approximately 15%, further driving the demand for managed DNS services that can mitigate risks associated with cyber attacks. This trend underscores the critical role of managed DNS solutions in safeguarding digital assets and maintaining operational integrity in an increasingly hostile cyber environment.

Expansion of Cloud Infrastructure

The expansion of cloud infrastructure in Brazil is a pivotal driver for the managed dns-services market. As organizations increasingly migrate to cloud-based solutions, the need for efficient DNS management becomes critical. In 2025, cloud adoption in Brazil is expected to reach approximately 30%, creating a substantial market for managed DNS services that can seamlessly integrate with cloud environments. This shift not only enhances operational efficiency but also necessitates advanced DNS capabilities to support dynamic workloads and ensure high availability. Consequently, managed DNS providers are likely to innovate and offer tailored solutions that cater to the unique demands of cloud users. The managed dns-services market stands to gain significantly from this trend, as businesses seek to optimize their cloud strategies through effective DNS management.

Rising Demand for Digital Services

The managed dns-services market in Brazil experiences a notable surge in demand due to the increasing reliance on digital services across various sectors. As businesses transition to online platforms, the need for reliable and efficient DNS management becomes paramount. In 2025, the Brazilian digital economy is projected to grow by approximately 20%, driving the necessity for robust managed DNS solutions. This growth is indicative of a broader trend where companies prioritize uptime and performance, leading to a heightened focus on managed DNS services. Furthermore, the proliferation of e-commerce and online applications necessitates enhanced DNS capabilities, thereby propelling the managed dns-services market forward. Companies are increasingly recognizing that effective DNS management is critical for maintaining competitive advantage in a rapidly evolving digital landscape.

Regulatory Compliance and Data Sovereignty

In Brazil, regulatory compliance and data sovereignty are becoming increasingly significant factors influencing the managed dns-services market. The Brazilian General Data Protection Law (LGPD) mandates strict data handling and privacy protocols, compelling organizations to adopt managed DNS services that ensure compliance. As businesses strive to align with these regulations, the demand for DNS solutions that offer data localization and security features is likely to rise. This trend is further supported by the growing awareness of data privacy among consumers, which drives companies to invest in managed DNS services that can safeguard sensitive information. The managed dns-services market is thus positioned to benefit from this regulatory landscape, as organizations seek to mitigate risks associated with non-compliance and enhance their reputational standing.