GCC Managed DNS Services Market Segment Insights

Managed DNS Services Market Service Type Insights

The GCC Managed DNS Services Market is characterized by a diverse range of service offerings, primarily classified under various types, each catering to specific needs of businesses in the region. One of the prominent categories is Premium or Advanced DNS, which has gained traction due to its ability to enhance website performance and reliability through features such as faster query responses and advanced traffic management. Advanced DNS solutions are especially critical for enterprises with high availability requirements, as they offer added layers of security and improved user experiences. The DDoS Protected DNS segment is another vital component of the GCC Managed DNS Services Market, addressing the increasing threat of cyber attacks that disrupt online services. As businesses in GCC continue to digitize their operations, the need for DDoS protection has become paramount.

This service ensures that organizations can maintain service continuity even in the face of malicious attacks, thereby safeguarding their reputations and customer trust. The growing emphasis on cybersecurity measures in GCC, driven by increasing regulations and awareness, underscores the importance of DDoS Protected DNS solutions in maintaining a robust digital presence.Furthermore, GeoDNS is emerging as a significant player in the market, providing businesses the capability to direct users to the nearest server locations based on geographical data. This type of DNS service not only enhances load times but also ensures better service delivery across various geographic regions, which is particularly beneficial for the expansive and diverse market landscape of the GCC.

With the region hosting numerous multinational enterprises and tech startups, the adoption of GeoDNS solutions facilitates improved user experiences and operational efficiencies. The GCC's strategic location as a hub for trade and commerce further highlights the necessity for GeoDNS services, as organizations strive to offer localized services to enhance customer satisfaction.Collectively, these service types cater to unique but essential requirements within the GCC Managed DNS Services Market, illustrating the sector's adaptability to the evolving digital landscape. The market is poised for substantial growth, driven by increasing digital adoption, heightened cybersecurity needs, and a continuous push for optimized, user-friendly services as businesses navigate the complexities of the online environment.

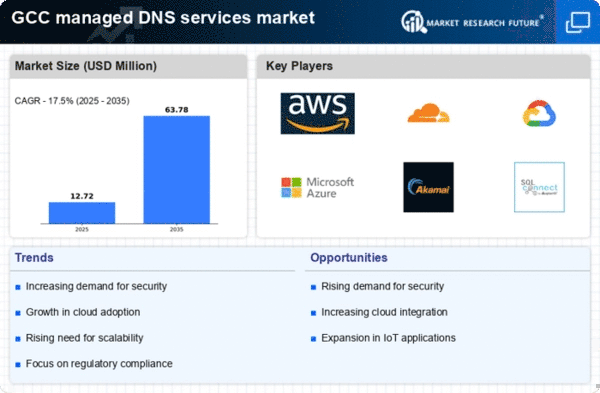

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Managed DNS Services Market Organization Size Insights

The Organization Size segment of the GCC Managed DNS Services Market plays a pivotal role in shaping the overall landscape of the industry. Large Enterprises are increasingly recognizing the significance of managed DNS services as they aim to enhance operational efficiencies and ensure scalability. These organizations often have extensive IT infrastructure needs that drive demand for robust and reliable DNS management solutions. Conversely, Small and Medium Enterprises (SMEs) are also emerging as key players within this market. As SMEs embrace digital transformation, they seek cost-effective managed DNS solutions that can streamline their online presence and improve operational reliability.

The growth of the digital economy in the GCC region fosters opportunities for both large enterprises and SMEs, encouraging investments in Managed DNS Services. Factors such as increasing internet penetration, the rise of e-commerce, and the ongoing shift towards cloud-based solutions are propelling market growth across both organization sizes. Additionally, the diversity in the telecommunications landscape within the GCC enhances the demand for tailored DNS services that address specific organizational needs, making it critical for service providers to understand and cater to these different organizational dynamics while navigating the evolving market landscape.

Managed DNS Services Market End User Insights

The End User segment of the GCC Managed DNS Services Market plays a crucial role in driving the region's digital transformation efforts. It comprises various industries such as Banking, Financial Services and Insurance (BFSI), Media and Entertainment, Retail and Consumer Goods, Healthcare, Government, Education, and E-Commerce, each contributing significantly to market dynamics. The BFSI sector relies heavily on robust managed DNS solutions for enhancing security and uptime, which is vital for protecting sensitive financial data and facilitating online transactions.Meanwhile, the Media and Entertainment industry leverages these services to ensure seamless content delivery and user experience, capitalizing on the growing demand for digital streaming. Retail and Consumer Goods thrive on quick and reliable web access to improve customer engagement and sales, while the Healthcare sector benefits from managed DNS for the protection of patient information and regulatory compliance.

Government agencies utilize these services to enhance their online presence and citizen engagement, ensuring reliable access to services.The Education sector sees increasing adoption of digital learning platforms, demanding robust DNS support. E-Commerce stands out with its rapid growth, necessitating high-performance DNS services for transaction processing and online accessibility. Overall, the End User segment is poised for substantial growth, reflecting the increasing dependence on managed DNS solutions across various industries in the GCC region.