Innovation in Materials

The combat helmet market in Malaysia is significantly influenced by innovations in materials used for helmet production. The introduction of lightweight, high-strength materials such as aramid fibers and polyethylene composites has revolutionized helmet design. These materials not only enhance protection but also improve comfort and usability for the wearer. The combat helmet market is witnessing a shift towards helmets that offer better ballistic protection while being lighter, which is crucial for operational efficiency. As manufacturers invest in research and development, the market is expected to see a rise in products that meet stringent safety standards. This trend is likely to attract both military and civilian customers, further expanding the market's reach.

Rising Security Concerns

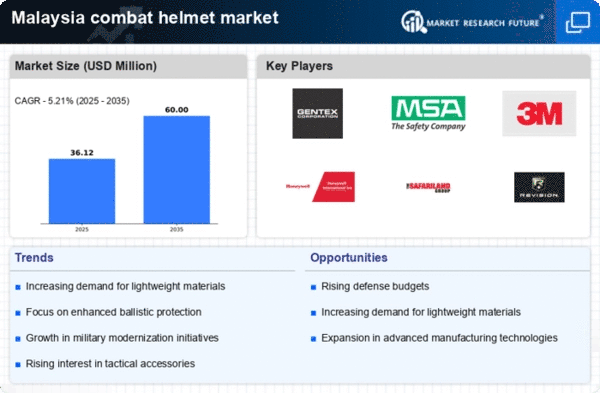

The combat helmet market in Malaysia is experiencing growth due to escalating security concerns. The government and military organizations are increasingly prioritizing the safety of personnel in various operations. This heightened focus on security is reflected in the allocation of budgets, with defense spending projected to rise by approximately 5% annually. As threats evolve, the demand for advanced protective gear, including combat helmets, is likely to increase. The combat helmet market is thus positioned to benefit from these trends, as both public and private sectors seek to enhance their protective measures. Furthermore, the emphasis on personal safety in urban areas has led to a broader acceptance of advanced combat helmets, which are now seen as essential equipment for law enforcement and military personnel alike.

Increased Military Modernization

The combat helmet market in Malaysia is benefiting from the ongoing military modernization initiatives. The Malaysian Armed Forces are actively upgrading their equipment to meet contemporary warfare demands. This modernization includes the procurement of advanced combat helmets that provide enhanced protection and functionality. Reports indicate that military expenditure in Malaysia is expected to reach approximately $4 billion by 2026, with a significant portion allocated to personal protective equipment. The combat helmet market is thus poised for growth as the military seeks to equip its personnel with state-of-the-art gear. This trend not only enhances the safety of soldiers but also boosts the overall capabilities of the armed forces.

Growing Demand from Law Enforcement

The combat helmet market in Malaysia is experiencing a surge in demand from law enforcement agencies. As public safety concerns rise, police and security forces are increasingly adopting advanced protective gear, including combat helmets. The combat helmet market is likely to see a substantial increase in orders from these agencies, driven by the need for enhanced protection during operations. Furthermore, the government is investing in training and equipping law enforcement personnel, which is expected to further stimulate market growth. The trend towards adopting military-grade helmets for police use reflects a broader recognition of the importance of personal safety in maintaining public order.

Focus on Customization and Personalization

The combat helmet market in Malaysia is witnessing a trend towards customization and personalization of helmets. As users seek gear that meets their specific needs, manufacturers are responding by offering tailored solutions. This includes adjustable features, modular designs, and options for integrating communication systems. The combat helmet market is adapting to these demands, with companies investing in technologies that allow for greater customization. This trend is particularly relevant for military and law enforcement agencies, where individual preferences can significantly impact operational effectiveness. As the market evolves, the ability to provide personalized helmets may become a key differentiator for manufacturers, potentially leading to increased market share.