Rising Security Concerns

The combat helmet market in China is experiencing growth due to escalating security concerns. The government has been increasingly focused on enhancing national defense capabilities, which has led to a surge in military procurement. In 2025, military expenditure is projected to reach approximately $250 billion, reflecting a 7% increase from the previous year. This heightened spending is likely to bolster demand for advanced combat helmets, which are essential for soldier protection. Furthermore, the emphasis on counter-terrorism and internal security operations necessitates the acquisition of high-quality protective gear. As a result, manufacturers are expected to innovate and produce helmets that meet the evolving needs of the armed forces, thereby driving the combat helmet market forward.

Focus on Export Opportunities

China's combat helmet market is poised for growth due to the increasing focus on export opportunities. As domestic production capabilities improve, manufacturers are looking to expand their reach into international markets. The global demand for high-quality combat helmets is on the rise, with countries seeking reliable suppliers. In 2025, it is estimated that exports could account for up to 20% of total production, driven by competitive pricing and advanced technology. This trend suggests that Chinese manufacturers are not only meeting domestic needs but are also positioning themselves as key players in The combat helmet market. The potential for increased revenue from exports may encourage further investment in production and innovation, thereby enhancing the overall market landscape.

Technological Integration in Defense

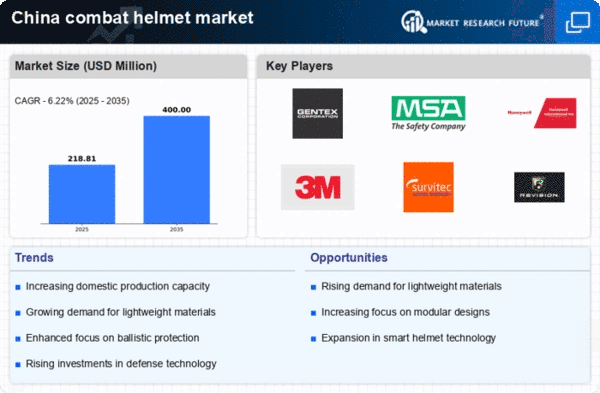

The integration of advanced technologies in defense systems is significantly influencing the combat helmet market in China. Innovations such as lightweight materials, enhanced ballistic protection, and integrated communication systems are becoming increasingly prevalent. The market is projected to grow at a CAGR of 5% over the next five years, driven by these technological advancements. Manufacturers are investing in research and development to create helmets that not only provide superior protection but also enhance situational awareness for soldiers. The incorporation of smart technologies, such as heads-up displays and augmented reality, is likely to redefine the functionality of combat helmets. This trend indicates a shift towards more sophisticated protective gear, which is essential for modern warfare, thus propelling the combat helmet market.

Growing Demand from Law Enforcement Agencies

The combat helmet market in China is also witnessing increased demand from law enforcement agencies. As public safety concerns rise, police and security forces are seeking advanced protective gear to ensure the safety of their personnel. The market for law enforcement helmets is projected to grow by 6% annually, driven by the need for enhanced protection during civil unrest and public demonstrations. This trend indicates a broader application of combat helmets beyond military use, expanding the market's potential. Manufacturers are likely to respond by developing helmets that cater specifically to the needs of law enforcement, incorporating features such as communication systems and modular designs. This diversification of the combat helmet market could lead to increased sales and innovation.

Government Initiatives for Defense Modernization

In China, government initiatives aimed at modernizing the military are playing a crucial role in shaping the combat helmet market. The 'Military-Civil Fusion' strategy encourages collaboration between military and civilian sectors, fostering innovation in defense technologies. This initiative is expected to lead to a more robust supply chain for combat helmets, enhancing production capabilities. By 2026, the government aims to allocate approximately $30 billion towards upgrading military equipment, including personal protective gear. Such investments are likely to stimulate the combat helmet market, as manufacturers align their products with the latest defense requirements. The focus on modernization not only enhances the quality of helmets but also ensures that they meet international standards, thereby increasing their competitiveness.