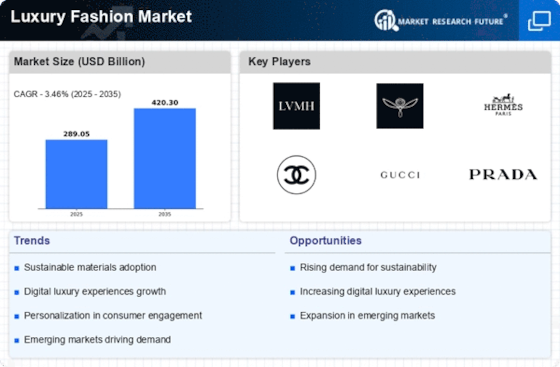

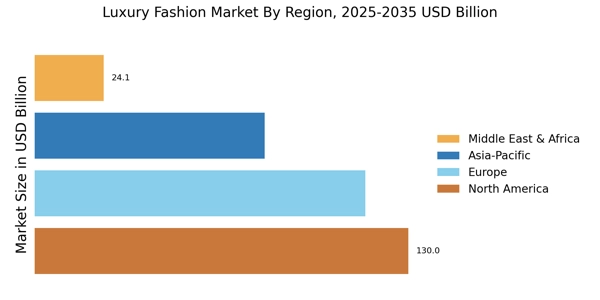

North America : Luxury Market Resilience

North America is a leading market for luxury fashion, driven by high disposable incomes and a growing appetite for premium brands. The U.S. holds the largest share at approximately 45%, followed by Canada at around 15%. Regulatory support for luxury goods, including favorable trade agreements, has further fueled growth. The demand for sustainable and ethically produced luxury items is also on the rise, influencing purchasing decisions. The competitive landscape is dominated by key players such as LVMH, Gucci, and Chanel, which have established a strong presence in major cities like New York and Los Angeles. The market is characterized by a blend of traditional luxury and innovative retail experiences, including online platforms. As consumer preferences evolve, brands are increasingly focusing on personalization and exclusivity to attract affluent customers.

Europe : Cultural Epicenter of Luxury

Europe remains the heart of the luxury fashion market, with France and Italy leading the charge. France accounts for approximately 40% of the market, while Italy follows closely with around 30%. The region benefits from a rich cultural heritage and a strong emphasis on craftsmanship, which drives demand for high-quality luxury goods. Regulatory frameworks in the EU promote sustainability and ethical practices, enhancing the appeal of European luxury brands. Key players like Hermès, Dior, and Prada are headquartered in Europe, contributing to a competitive landscape that thrives on innovation and tradition. Countries such as Germany and the UK also play significant roles, with a growing number of luxury consumers. The market is increasingly influenced by digital transformation, with brands investing in e-commerce and social media strategies to engage younger consumers. The Europe luxury fashion market remains the cultural and economic epicenter of the global luxury industry, driven by France and Italy’s longstanding leadership in haute couture and premium craftsmanship.

Asia-Pacific : Emerging Luxury Powerhouse

The Asia-Pacific region is rapidly emerging as a powerhouse in the luxury fashion market, with China leading the way, holding approximately 35% of the market share. Japan and South Korea follow, contributing around 20% and 10%, respectively. The region's growth is fueled by rising disposable incomes, a burgeoning middle class, and a strong affinity for luxury brands. Regulatory initiatives promoting local production and sustainability are also shaping market dynamics. The luxury fashion market in China post-pandemic has shown strong recovery momentum, supported by rising domestic consumption, digital-first luxury shopping behavior, and renewed consumer confidence. China's luxury market is characterized by a mix of traditional and modern retail experiences, with brands like Burberry and Versace adapting to local tastes. The competitive landscape is vibrant, with both international and local brands vying for consumer attention. As digital commerce continues to expand, luxury brands are increasingly focusing on online strategies to capture the tech-savvy consumer base in this region.

Middle East and Africa : Luxury Market Evolution

The Middle East and Africa region is witnessing a notable evolution in the luxury fashion market Share, with the UAE leading the charge, holding approximately 25% of the market share. Saudi Arabia follows closely with around 15%. The region's growth is driven by a young, affluent population and increasing tourism, which boosts demand for luxury goods. Regulatory frameworks are becoming more supportive, encouraging foreign investment in the luxury sector. Key players like Chanel and Dior have established a strong presence in the UAE, particularly in cities like Dubai and Abu Dhabi. The competitive landscape is marked by a blend of international brands and emerging local designers. As the market matures, there is a growing emphasis on unique shopping experiences and personalized services to cater to the discerning luxury consumer.