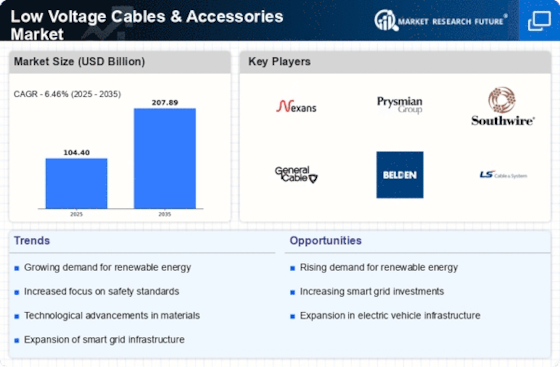

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is driving the Low Voltage Cables & Accessories Market. As countries strive to meet energy transition goals, the installation of solar panels and wind turbines necessitates the use of low voltage cables for efficient energy distribution. In 2025, the demand for low voltage cables in renewable energy applications is projected to grow by approximately 15%, reflecting a shift towards sustainable energy solutions. This trend not only supports environmental objectives but also stimulates economic growth within the Low Voltage Cables & Accessories Market, as manufacturers adapt to the evolving needs of the energy sector.

Increased Focus on Safety Standards

The heightened focus on safety standards is a critical driver for the Low Voltage Cables & Accessories Market. Regulatory bodies are implementing stringent safety regulations to minimize electrical hazards, which necessitates the use of high-quality low voltage cables. In 2025, compliance with these safety standards is projected to influence purchasing decisions significantly, as consumers and businesses prioritize safety in electrical installations. This trend not only enhances the reputation of manufacturers who adhere to these standards but also contributes to the overall growth of the Low Voltage Cables & Accessories Market, as safer products gain market acceptance.

Urbanization and Infrastructure Development

Rapid urbanization is significantly influencing the Low Voltage Cables & Accessories Market. As urban areas expand, the need for robust electrical infrastructure becomes paramount. The construction of residential and commercial buildings requires extensive electrical wiring, which relies heavily on low voltage cables. In 2025, it is estimated that the construction sector will account for nearly 40% of the total demand for low voltage cables. This surge in infrastructure development not only enhances connectivity but also propels the growth of the Low Voltage Cables & Accessories Market, as manufacturers respond to the increasing requirements for reliable electrical systems.

Expansion of Electric Vehicle Infrastructure

The expansion of electric vehicle (EV) infrastructure is emerging as a pivotal driver for the Low Voltage Cables & Accessories Market. As the adoption of electric vehicles accelerates, the demand for charging stations and related electrical infrastructure is surging. Low voltage cables are essential for connecting EV charging stations to the power grid, facilitating efficient energy transfer. In 2025, the market for low voltage cables in the EV sector is anticipated to grow by over 20%, reflecting the increasing investment in sustainable transportation solutions. This trend not only supports the growth of the Low Voltage Cables & Accessories Market but also aligns with broader environmental goals.

Technological Innovations in Cable Manufacturing

Technological advancements in cable manufacturing are reshaping the Low Voltage Cables & Accessories Market. Innovations such as improved insulation materials and enhanced conductivity are leading to the production of more efficient and durable low voltage cables. These advancements not only reduce energy losses but also extend the lifespan of electrical systems. In 2025, the market is expected to witness a rise in demand for high-performance cables, driven by the need for energy-efficient solutions. Consequently, manufacturers are investing in research and development to stay competitive, thereby fostering growth within the Low Voltage Cables & Accessories Market.