Liquid Biopsy Size

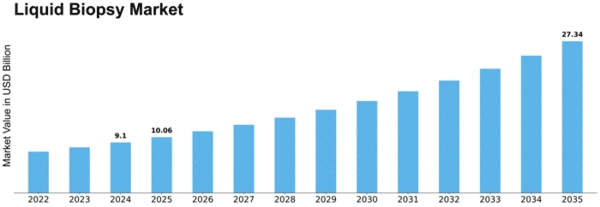

Liquid Biopsy Market Growth Projections and Opportunities

A liquid biopsy represents a largely non-invasive method for sampling and analyzing liquid state biological tissues to diagnose and monitor diseases, primarily focusing on conditions like cancer. This approach directly applies advancements in medical science, particularly human genome sequencing and the increased sensitivity of detection techniques and assays. The essence of liquid biopsy lies in harnessing the qualitative and quantitative distinctions among various biomarkers found in a patient's blood, such as cell-free DNA, circulating tumor cells (CTCs), cell-free RNA (cfRNA) fragments, methylated ctDNA, and miRNA. While these fragments may be released during other conditions like trauma, their composition, concentration, and degree of fragmentation exhibit a quantitative difference. Notably, the presence of mutations reflects a direct relationship with the source tissue. These separated biomarkers undergo sequencing, amplification, and analysis, providing comprehensive information about the disease and any changes resulting from treatment. This revolutionary process, completed in approximately 15 days, signifies a paradigm shift in disease diagnosis, treatment, and mitigation, benefiting all stakeholders. Healthcare professionals gain timely access to rich information, while patients experience the relatively pain-free and non-invasive nature of the technique. Early detection becomes a significant advantage, significantly increasing the chances of complete disease mitigation.

While blood remains the most common sample, other fluid samples like urine and saliva are increasingly utilized. The technique involves separating and concentrating biomarkers in the fluid sample, qualitatively and quantitatively analyzing them for disease detection, monitoring, and prognosis. Its applications extend beyond cancer to encompass cardiovascular diseases, transplantation, reproductive health, and more. However, blood remains the dominant sample, surpassing alternatives like urine.

In contrast to traditional biopsy, liquid biopsy mitigates numerous drawbacks, including economic and emotional costs due to its painful nature, delays in obtaining results, and the potential for false results. Additionally, traditional biopsy procedures often need repetition alongside imaging techniques like CT scans to assess treatment effects and plan future courses of action. Liquid biopsy, on the other hand, overcomes these challenges and achieves higher detection rates, particularly crucial in preventive medicine, especially for cancer. Nonetheless, certain drawbacks persist, such as cost considerations, lower detection rates for specific cancers like brain cancer, variable false results across different cancer types (ranging from 5% to 15%), and the invasive nature of obtaining spinal fluid samples.

Leave a Comment