Increased Focus on Aesthetic Appeal

Aesthetic considerations are becoming increasingly important in the Lighting Fixtures and Luminaires Market. Consumers are not only looking for functional lighting solutions but also for products that enhance the visual appeal of their spaces. This trend is driving manufacturers to innovate and design lighting fixtures that are both stylish and functional. The rise of interior design trends that emphasize ambiance and mood lighting is contributing to this shift. Market data suggests that decorative lighting segments are witnessing a growth rate of around 6% annually. As consumers prioritize aesthetics alongside functionality, the Lighting Fixtures and Luminaires Market is likely to adapt to these evolving preferences.

Government Initiatives and Regulations

Government initiatives and regulations play a crucial role in shaping the Lighting Fixtures and Luminaires Market. Many governments are implementing policies aimed at promoting energy efficiency and sustainability in lighting solutions. These initiatives often include incentives for adopting energy-efficient technologies and stricter regulations on traditional lighting products. For instance, several countries have phased out incandescent bulbs in favor of more efficient alternatives. Such regulatory frameworks are expected to drive the market towards more sustainable lighting solutions. Market forecasts indicate that compliance with these regulations could lead to a market expansion of approximately 7% over the next few years, highlighting the influence of government actions on the Lighting Fixtures and Luminaires Market.

Technological Advancements in Lighting

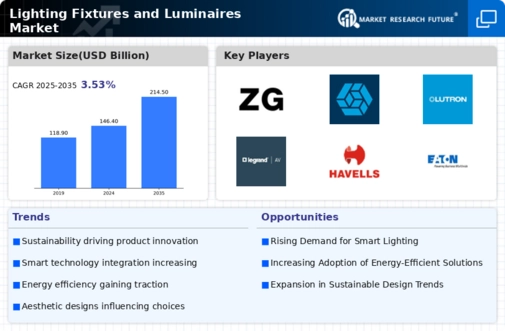

The Lighting Fixtures and Luminaires Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as LED technology and smart lighting systems are reshaping consumer preferences and driving demand. The integration of Internet of Things (IoT) capabilities into lighting solutions allows for enhanced control and energy efficiency. According to recent data, the adoption of LED lighting is projected to account for over 60% of the total lighting market by 2025. This shift not only reduces energy consumption but also extends the lifespan of lighting fixtures, making them more appealing to consumers. As technology continues to evolve, the Lighting Fixtures and Luminaires Market is likely to see further growth driven by these advancements.

Growing Demand for Energy-Efficient Solutions

In the Lighting Fixtures and Luminaires Market, the increasing emphasis on energy efficiency is a significant driver. Consumers and businesses alike are becoming more aware of the environmental impact of their energy consumption. This awareness is leading to a surge in demand for energy-efficient lighting solutions, particularly LED fixtures, which consume significantly less power compared to traditional incandescent bulbs. Market data indicates that energy-efficient lighting is expected to grow at a compound annual growth rate of approximately 8% through 2025. This trend is further supported by government regulations and incentives aimed at reducing energy consumption, thereby propelling the Lighting Fixtures and Luminaires Market forward.

Rising Urbanization and Infrastructure Development

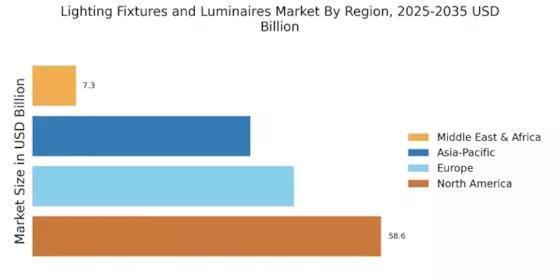

The Lighting Fixtures and Luminaires Market is being propelled by the ongoing trend of urbanization and infrastructure development. As urban areas expand, there is a growing need for effective lighting solutions in residential, commercial, and public spaces. This demand is particularly pronounced in developing regions, where urbanization rates are high. The construction of new buildings and the renovation of existing structures necessitate the installation of modern lighting fixtures. Market analysis suggests that the urbanization trend could lead to a substantial increase in the demand for lighting products, with projections indicating a potential market growth of over 10% in the next few years. This dynamic environment presents a lucrative opportunity for stakeholders in the Lighting Fixtures and Luminaires Market.