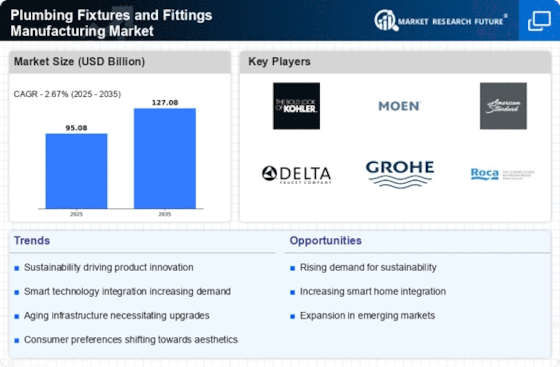

The Plumbing Fixtures and Fittings Manufacturing Market is currently characterized by a dynamic competitive landscape, driven by innovation, sustainability, and digital transformation. Major players such as Kohler Co. (US), Moen Incorporated (US), and TOTO Ltd. (JP) are actively shaping the market through strategic initiatives that emphasize product differentiation and customer engagement. Kohler Co. (US) has positioned itself as a leader in luxury and high-performance fixtures, focusing on smart technology integration to enhance user experience. Meanwhile, Moen Incorporated (US) has adopted a strategy centered on sustainability, launching a new line of water-saving faucets that align with global conservation efforts. TOTO Ltd. (JP) continues to innovate with its advanced toilet technologies, which emphasize hygiene and efficiency, thereby reinforcing its competitive edge in the market.

The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing processes. The market structure appears moderately fragmented, with a mix of established brands and emerging players vying for market share. This fragmentation allows for diverse consumer preferences to be met, while the collective influence of key players drives innovation and sets industry standards.

In August 2025, Kohler Co. (US) announced the launch of its new smart bathroom collection, which integrates IoT technology to provide users with personalized experiences. This strategic move not only enhances Kohler's product offerings but also positions the company at the forefront of the smart home trend, appealing to tech-savvy consumers. The introduction of such innovative products is likely to strengthen Kohler's market position and attract a broader customer base.

In September 2025, Moen Incorporated (US) unveiled its partnership with a leading environmental organization to promote water conservation initiatives. This collaboration aims to educate consumers on the importance of sustainable water usage while promoting Moen's eco-friendly product lines. By aligning its brand with sustainability efforts, Moen enhances its corporate image and appeals to environmentally conscious consumers, which could lead to increased market share.

In July 2025, TOTO Ltd. (JP) expanded its operations into the European market by acquiring a local plumbing fixtures manufacturer. This strategic acquisition not only broadens TOTO's geographical footprint but also allows the company to leverage local expertise and distribution networks. Such moves are indicative of TOTO's commitment to growth and its strategy to enhance its competitive positioning in a key market.

As of October 2025, the competitive trends in the Plumbing Fixtures and Fittings Manufacturing Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and expanding market reach. Looking ahead, it is anticipated that competitive differentiation will evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This evolution suggests that companies that prioritize these aspects will likely emerge as leaders in the market.

Leave a Comment