Market Trends

Key Emerging Trends in the Light Commercial Vehicles Market

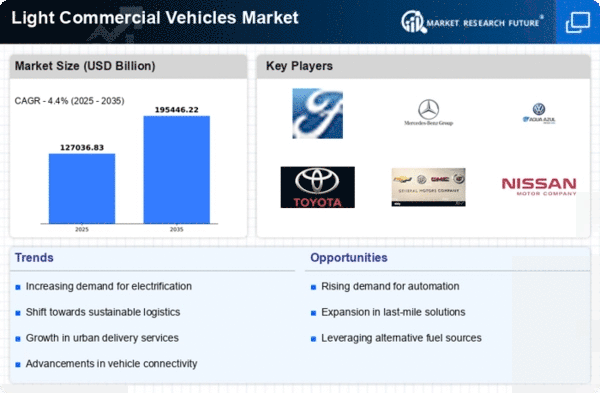

A clear trend is the growing demand in electric and hybrid LCVs, which is being fueled by increased attention to sustainability and environmental consciousness. Organizations are gradually adopting greener and cleaner solutions instead of traditional fuel-controlled automobiles as authorities enforce strict emission regulations. This change is a necessary step toward reducing functional expenses in the long run as well as a response to administrative conflicts. These developments increase output, provide better course planning, and provide continuous monitoring of vehicle performance. Businesses are seeing the benefits of these advancements in terms of improving operational productivity, reducing idle time, and ensuring optimal delivery, all of which increase customer loyalty. Similarly, the industry is witnessing a transition toward LCV concepts that are more versatile and adaptable. Manufacturers are introducing models that can adapt to various business requirements, such as last-mile transportation, flexible studios, and goods transportation. This flexibility is especially important when businesses want to improve their fleets for various projects, providing a cost-effective and adaptable solution to meet changing market demands. Additionally, the explosion of online businesses has had a significant impact on the LCV sector, driving up demand for cars fitted with efficient last-mile transportation. The need for LCVs that offer better mobility in urban settings and can handle the challenges of frequent stops and starts is growing as online shopping continues to grow. In response, manufacturers are designing LCVs with features specifically tailored to the transportation and tactics domain's requirements. The global trend toward close assembly and disruptions in store networks are also influencing the LCV industry. As a result, there is a growing trend for neighbourhood development and acquisition, which affects the distribution and offers real-world instances of LCVs. To conform to this trend and ensure adaptability in the face of future disruptions, makers are modifying their invention and production network strategies. High-level driver assistance systems, crash avoidance, and autonomous crisis braking are becoming standard in many LCV models, contributing to improved road safety, and lowering the risk of accidents. Companies and manufacturers investigating these trends are prepared to take advantage of newly created opportunities and satisfy the evolving needs of the market. As the LCV landscape continues to evolve, adaptability and progress will remain crucial factors in shaping this market’s fate.

Leave a Comment