Market Analysis

In-depth Analysis of Light Commercial Vehicles Market Industry Landscape

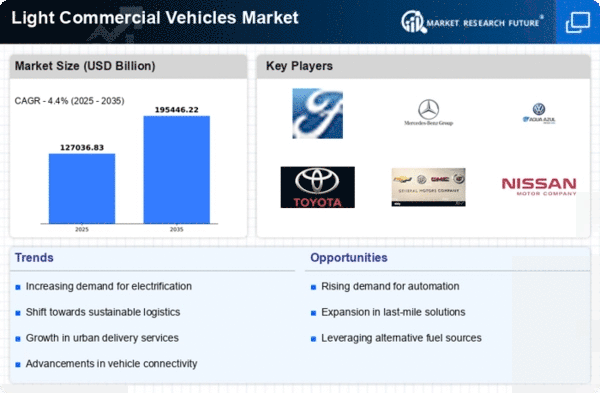

Often referred to as small trucks or vans, LCVs provide specialized care for a diverse range of organizations and play a vital role in assisting with product development for a variety of businesses. The state of the economy is a major factor driving the LCV industry as it directly affects businesses' purchasing power and capacity to invest in new cars. Organizations usually extend their fleets during periods of financial development to meet growing demand, which fuels the interest in LCVs. As a result, there is a growing focus on the development of electric and hybrid cars as well as stronger discharge regulations. This change is pushing LCV manufacturers to invest in the development of models that are safe for the ecosystem and to modify their products to meet evolving regulatory requirements and customer preferences. Fleet managers are searching more and more for vehicles with the newest technology available in order to increase performance, save maintenance costs, and increase operational efficiency. Manufacturers who concentrate on mechanical innovation are therefore in a better position to address the evolving needs of businesses and secure a share of the market. Drifts in purchasers also contribute to the fluid concept of the LCV market. More affordable, more versatile cars are becoming more and more popular due to the growth of internet commerce and the growing need for last-mile transportation services. This tendency is further strengthened by urbanization, as companies search for more agile and compact LCVs to navigate congested city streets. Additionally, firms are being forced to modify their fleet processes in response to shifting customer expectations regarding the comfort and speed of conveyances, with a preference for LCVs that can effectively handle the demands of current strategies. Businesses who can achieve some degree of balance between these factors will have an advantage in a market where consumers are becoming more knowledgeable and value-aware. Important groups, mergers, and acquisitions also have a role in changing the landscape, affecting the roles and shareholdings of key players in the LCV sector. Producers and industry collaborators must investigate this bewildering situation and modify their approaches to stay ahead of emerging trends and satisfy the various needs of companies in a rapidly evolving global environment.

Leave a Comment