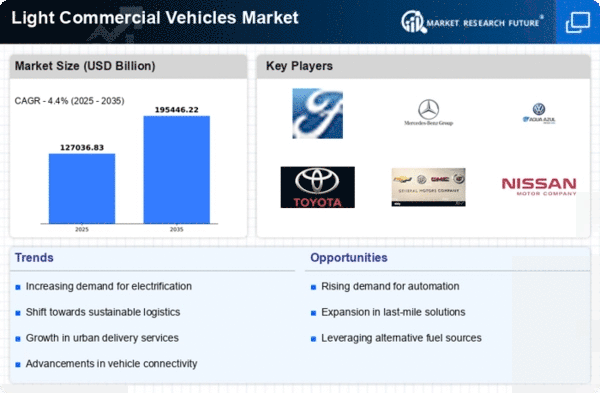

Market Share

Light Commercial Vehicles Market Share Analysis

One common methodology is separation, where organizations endeavor to recognize their items from rivals through exceptional highlights, plan components, or innovative progressions. By offering something, organizations can draw in a particular fragment of clients who esteem development and uniqueness. This methodology assists in working with marking faithfulness as well as considers a top-notch estimating model, subsequently improving overall revenues. Businesses using the expenditure initiative approach want to capture a larger share of the market by providing LCVs at a reduced cost, particularly to clients who are cost-conscious. This strategy necessitates a close examination of economies of scale, which enable businesses to produce in large quantities and pass along cost savings to customers. Organizations may leverage their areas of expertise to gain recognition and customer loyalty within a certain segment by becoming specialists in servicing that group of clients. A one-size-fits-all strategy might not be as successful in company sectors with diverse needs and preferences as this one. Collaboration and important organizations also play a crucial role in the pie that is located inside the LCV region. Organizations can use one other's resources, share resources, and work together to solve market challenges when they engage in cooperative ventures. These kinds of relationships can foster cooperative energies that increase seriousness and one's share of the pie. Organizations can satisfy administrative requirements and attract naturally aware clients by positioning themselves as leaders in green innovation. This crucial action places companies as innovative and credible market participants while also aligning with global trends. Additionally, customer-driven practices like outstanding after-deals management and guarantee programs play a major role in piecing together a portion of the market. Establishing a reputation for steadfast quality and devoted customers may lead to repeat business and favourable word-of-mouth, which can eventually affect a segment of the industry. In a market where customer loyalty is essential, companies that prioritize the customer experience usually stand out.

Leave a Comment