Increasing Focus on Rapid Diagnostics

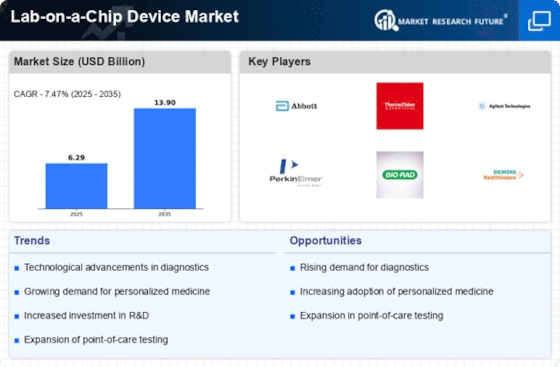

The Lab-on-a-Chip Device Market is witnessing an increasing focus on rapid diagnostics, which is becoming a critical component in healthcare delivery. The demand for quick and accurate diagnostic tools is rising, particularly in emergency and point-of-care settings. Lab-on-a-chip devices provide the capability to deliver results in a matter of minutes, which is essential for timely decision-making in clinical environments. The rapid diagnostics market is projected to reach USD 5 billion by 2026, indicating a strong inclination towards technologies that can expedite testing processes. This trend is likely to bolster the lab-on-a-chip market, as these devices are inherently designed for speed and efficiency.

Rising Demand for Personalized Medicine

The Lab-on-a-Chip Device Market is experiencing a notable surge in demand for personalized medicine. This trend is driven by the increasing recognition of the need for tailored therapeutic approaches that cater to individual patient profiles. As healthcare systems evolve, the integration of lab-on-a-chip technologies facilitates rapid diagnostics and targeted treatments, enhancing patient outcomes. The market for personalized medicine is projected to reach USD 2.5 trillion by 2025, indicating a robust growth trajectory. This growth is likely to propel the adoption of lab-on-a-chip devices, as they enable precise biomarker analysis and real-time monitoring, thereby aligning with the personalized medicine paradigm.

Advancements in Microfluidics Technology

Advancements in microfluidics technology are significantly influencing the Lab-on-a-Chip Device Market. Innovations in this field have led to the development of more efficient and cost-effective devices that can perform complex analyses with minimal sample volumes. The ability to manipulate small fluid volumes with high precision enhances the functionality of lab-on-a-chip devices, making them indispensable in various applications, including diagnostics and drug development. The microfluidics market is expected to grow at a CAGR of 20% from 2023 to 2030, suggesting that the proliferation of these technologies will further drive the lab-on-a-chip market, as they offer enhanced performance and versatility.

Growing Investment in Research and Development

Growing investment in research and development is a pivotal driver for the Lab-on-a-Chip Device Market. As stakeholders recognize the potential of lab-on-a-chip technologies in various fields, including healthcare, environmental monitoring, and food safety, funding for R&D initiatives is increasing. This investment is crucial for the innovation of new applications and the enhancement of existing technologies. In 2025, it is estimated that R&D spending in the life sciences sector will exceed USD 200 billion, which could significantly impact the lab-on-a-chip market by fostering advancements that improve device capabilities and broaden their application scope.

Regulatory Support for Innovative Technologies

Regulatory support for innovative technologies is emerging as a key driver in the Lab-on-a-Chip Device Market. Governments and regulatory bodies are increasingly recognizing the importance of facilitating the development and approval of novel diagnostic tools. This support is manifested through streamlined approval processes and incentives for companies developing lab-on-a-chip devices. Such regulatory frameworks are likely to encourage innovation and expedite the introduction of new products to the market. As a result, the lab-on-a-chip market may experience accelerated growth, with more companies entering the space and contributing to a diverse range of applications.