Regulatory Support

Regulatory frameworks are increasingly becoming a driving force in the Lab-Based Meat Market. Governments and regulatory bodies are beginning to establish guidelines and standards for the production and sale of lab-based meat products. This regulatory support is crucial for ensuring food safety and consumer confidence, which are essential for market acceptance. As more countries recognize the potential benefits of lab-based meat, including reduced environmental impact and improved food security, they are likely to implement favorable regulations. This could lead to a more streamlined approval process for lab-based meat products, facilitating their entry into the market. Consequently, the Lab-Based Meat Market stands to benefit from enhanced legitimacy and consumer trust, which may accelerate its growth trajectory.

Sustainability Concerns

The Lab-Based Meat Market is increasingly driven by growing concerns regarding environmental sustainability. Traditional meat production is associated with significant greenhouse gas emissions, deforestation, and water usage. In contrast, lab-based meat production is perceived as a more sustainable alternative, potentially reducing the carbon footprint by up to 96% compared to conventional meat. As consumers become more environmentally conscious, they are likely to seek out products that align with their values. This shift in consumer behavior is prompting companies within the Lab-Based Meat Market to innovate and develop sustainable practices, thereby enhancing their market appeal. Furthermore, regulatory bodies are beginning to recognize the importance of sustainability, which may lead to supportive policies that favor lab-based meat production. Consequently, the Lab-Based Meat Market is poised for growth as it addresses these pressing environmental issues.

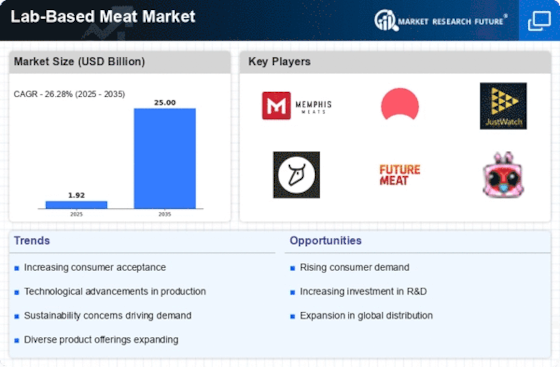

Technological Innovations

Technological advancements play a pivotal role in shaping the Lab-Based Meat Market. Innovations in cellular agriculture and tissue engineering are enabling the production of lab-based meat that closely mimics the taste and texture of traditional meat. These technologies are not only enhancing product quality but also reducing production costs, making lab-based meat more accessible to consumers. Market analysis suggests that the lab-grown meat sector could reach a valuation of several billion dollars in the coming years, driven by these technological breakthroughs. As research and development continue to progress, the Lab-Based Meat Market is likely to witness an influx of new products that cater to diverse consumer preferences, further solidifying its position in the food industry.

Health and Nutrition Trends

The Lab-Based Meat Market is also influenced by evolving health and nutrition trends. As consumers become more health-conscious, they are increasingly scrutinizing the nutritional content of their food. Lab-based meat products often offer a healthier alternative to traditional meat, as they can be engineered to contain lower levels of saturated fats and higher levels of beneficial nutrients. For instance, some lab-based meats are fortified with vitamins and minerals, appealing to health-oriented consumers. Market data indicates that the demand for healthier food options is on the rise, with a significant percentage of consumers willing to pay a premium for products that promote better health. This trend is likely to drive innovation within the Lab-Based Meat Market, as companies strive to meet the nutritional preferences of their target audience.

Changing Consumer Preferences

The Lab-Based Meat Market is significantly influenced by changing consumer preferences. A growing segment of the population is shifting towards plant-based and lab-grown alternatives due to ethical concerns surrounding animal welfare and the desire for more sustainable food sources. Market Research Future indicates that a substantial number of consumers are open to trying lab-based meat, with many expressing a willingness to incorporate it into their diets. This shift in preferences is prompting food manufacturers to diversify their offerings, leading to an increase in the availability of lab-based meat products. As consumer demand evolves, the Lab-Based Meat Market is likely to expand, driven by the need to cater to a more diverse and health-conscious consumer base.